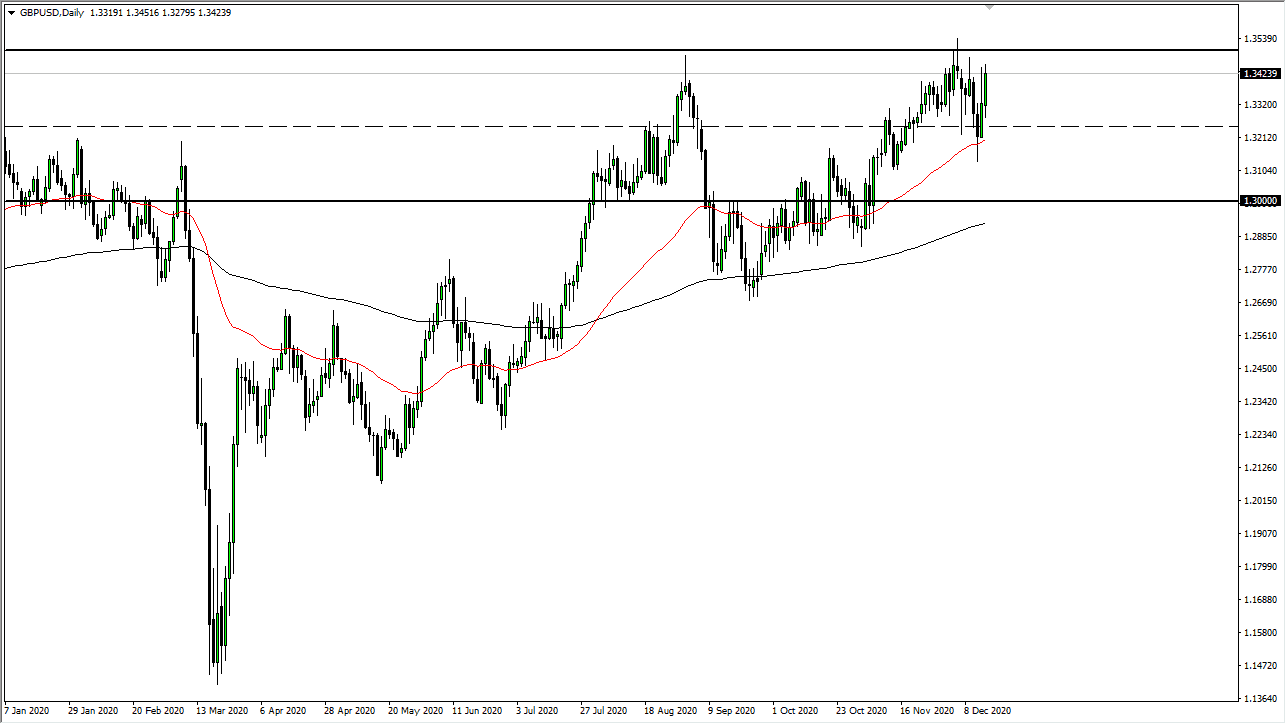

The British pound skyrocketed during the trading session again on Tuesday, reaching towards the 1.3450 level where it parked for the evening. This is a market that continues to try to break to the upside, but the 1.35 level will continue to be very difficult to cross. This is because even though the Federal Reserve has an announcement on Wednesday, it is going to take quite a bit to convince British pound traders to buy enough to send this market to the upside for a bigger move.

We could get a pullback heading into the announcement, and just like the euro, it could be a nice buying opportunity. This is especially true if we are closer to the 1.3250 level. The 50-day EMA is sitting just below there and turning to the upside, so I think it offers dynamic support. The biggest problem with this pair is that we also have all of the noise from Brexit, which could put a bit of a damper on what happens with the British pound in general.

Looking at this chart, it looks like we will eventually get a breakout, but we need a daily close above the 1.35 level which would suggest that we are going to go much higher. Short-term pullbacks continue to attract buyers from what I can see, so I have no interest in shorting the British pound anytime soon. To the downside, it is not until we break down below the 1.30 level that I would be concerned, because it would not only break a major figure, but it could also break down below the 200-day EMA. The market is already starting to show that it is trying to “lean to the upside”, which gives a hint to where we will eventually go. The question now is: are we going to do it on Wednesday, or is it going to take a bit more time to finally make that move? This all comes down to Brexit, but it looks like every time we pull back there are plenty of buyers try to take advantage of those moves.