The British pound broke down during the trading session on Tuesday as we continue to move based on the latest rumors and headlines surrounding Brexit. As we are approaching “crunch time”, we should finally see a bigger move, but at the moment we're still moving on headlines. During the trading session on Tuesday, it was clearly more of the same.

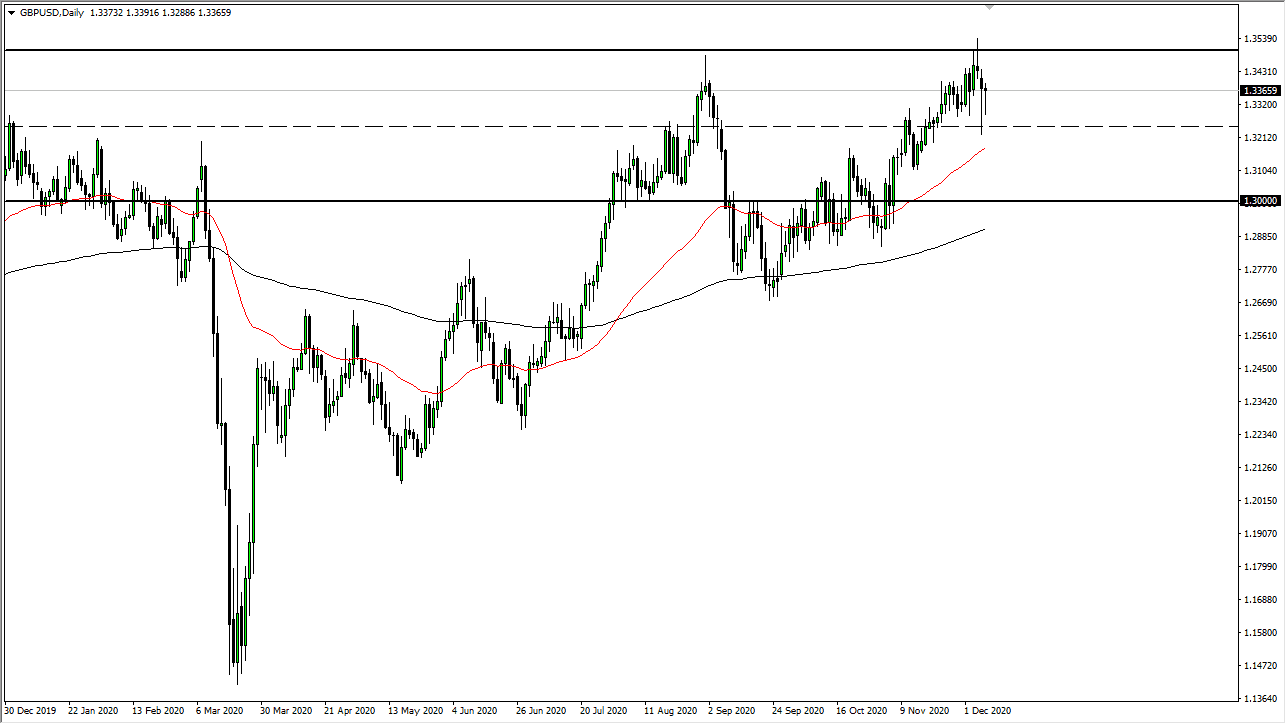

We had heard that an EU official suggested that “all of the outstanding points have been agreed upon, at least in principle.” That caused the British pound to rally after initially drifting lower during the trading session. After that, we heard multiple back-and-forth types of scenarios, which means more politicians playing games in the media than anything else. I think the market is simply running out of the will to trade as there is just far too much in the way of uncertainty. We will continue to just hang around the 1.3350 handle, with the 1.3250 level offering support, and the 1.35 level above offering significant resistance. The candlestick for the trading session on Tuesday looks just like the one on Monday, which is the exact opposite of the one on Friday. In other words, this is a market that is trying to figure out whether or not it can get any good news about Brexit in order to finally break out for a bigger move.

If we see a daily close above the 1.35 handle, is very likely that the market will continue to go higher, kicking off a bigger move to the upside. After all, this is a large, round, psychologically significant figure and a barrier that has had its influence in the market more than once. You will notice that the longer-term low that we had formed at the 200-day EMA is higher than the one before it, so I suspect that what we are looking at right now is an attempt to build up momentum to break off to the upside. If and when that happens, then it could open up a huge “buy-and-hold” type of opportunity.