The British pound skyrocketed during the trading session on Monday to kick off the week, reaching towards the 1.3450 level again. We gave back a significant amount of that move though, as the markets initially jumped due to the UK and the EU agreeing to continue talks about Brexit. However, the reality is that the market is still trying to figure out whether or not we are going to continue to see forward movement in Brexit. I do not think that is the case, at least not in the short term, so it will be very difficult to see this market break out for a longer-term “buy-and-hold” scenario anytime soon.

At this point, market participants are starting to understand that even if we do get past the new year’s deadline, the reality is that they can still work on an agreement shortly thereafter. There are plenty of buyers on dips and you have to pay attention to stimulus coming out the United States, because it will have a major influence on the US dollar. The bigger the stimulus, perhaps the more momentum will jump to the upside in this market.

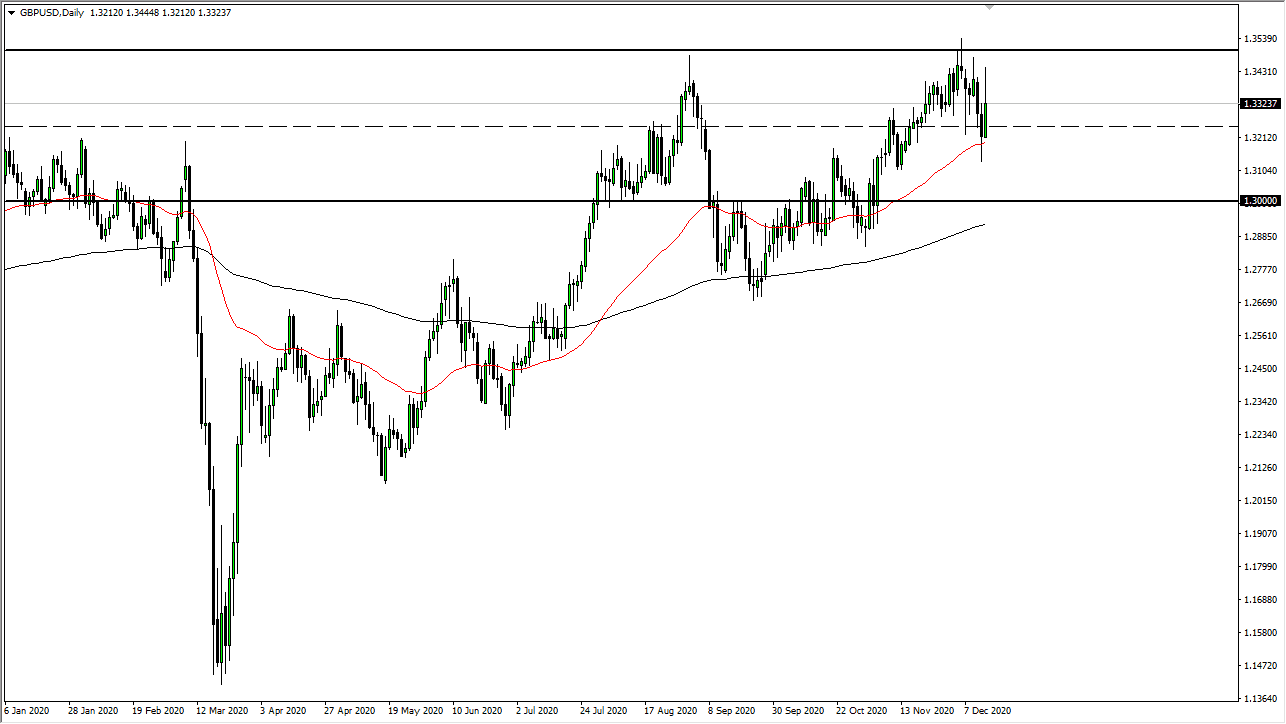

Looking at the chart, I believe that the 1.35 level is crucial, so if we were to break above there, and perhaps more importantly close above that on the daily chart, then we will go to the upside. The 50-day EMA underneath is supportive, near the 1.3250 level. Below there, the 1.30 level underneath is going to be massive support as well, as it is a large, round, psychologically significant figure and the 200-day EMA is reaching towards that region. That is a longer-term support for market participants who trade longer-term charts. There is plenty of support for the British pound underneath, so looking for a pullback to take advantage of might be the way that a lot of traders are going to be playing sterling. If we do break down below the 200-day EMA it would probably accompany a “no-deal Brexit”, and perhaps even a breakdown in talks.