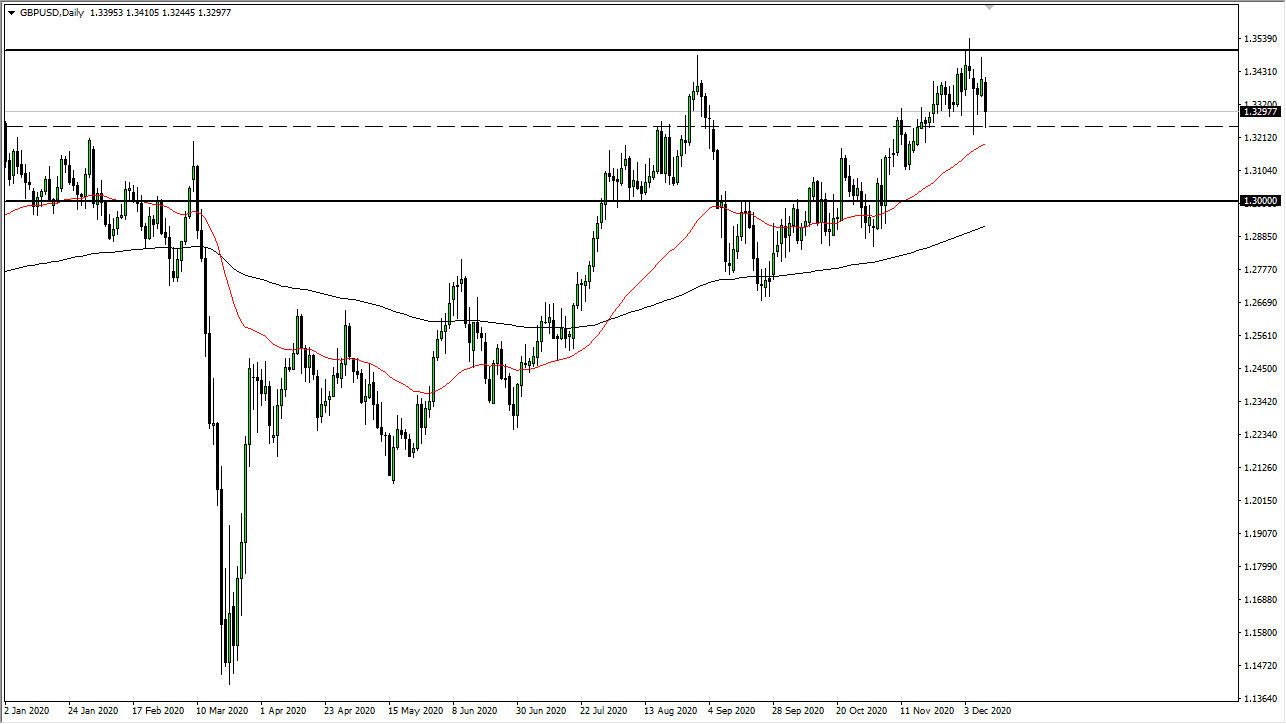

The British pound fell significantly during the trading session on Thursday to reach down towards the 1.3250 level. This is an area that has offered support more than once, so it follows that we have bounced a bit from there. We are closing lower than we have been over the last couple of sessions, which suggests that we are going to continue to see negativity.

If we were to break down below the 1.3250 level, the market could go looking towards the red 50-day EMA underneath. This is one of the multiple areas in wbhich we could see support underneath. Even if we break down below there, the 1.30 level is also supportive, and by the time we would get down there, the 200-day EMA would probably be in the same general vicinity as well. At this point, we are simply waiting to see what happens next with Brexit, but the disappointment from the recent negotiations will weigh on sterling as well.

What is interesting is that the British pound cannot pick up traction on a day when the US dollar has been hammered. This tells you just how soft the British pound is at the moment, so I think this tells us what we are probably going to continue to see: volatility and potential negativity. If the market can turn around and break above the 1.35 handle, then the British pound is likely to go looking towards the 1.3750 level, possibly even the 1.40 level above. This probably will not happen anytime soon though, because we need a Brexit deal or at least some certainty as to what will happen next, and we are nowhere near that. The market is likely to see some hesitation; however, it is noted that the negotiators between the United Kingdom and the European Union are supposed to come up with a plan to speak to each other again by Sunday, so the negotiations drag on ad infinitum. Because of this, and because of the fact that we continue to see that hope burns eternal when it comes to the British pound, it is difficult to short this market, but it is likely to be difficult in general. Buying dips probably will continue to work, but we may have lower prices ahead before I am tempted to start buying again.