By reviewing the GBP/USD Forex signal on the 7th of December, we find that the pair has activated the stop loss order.

Short Trade Ideas

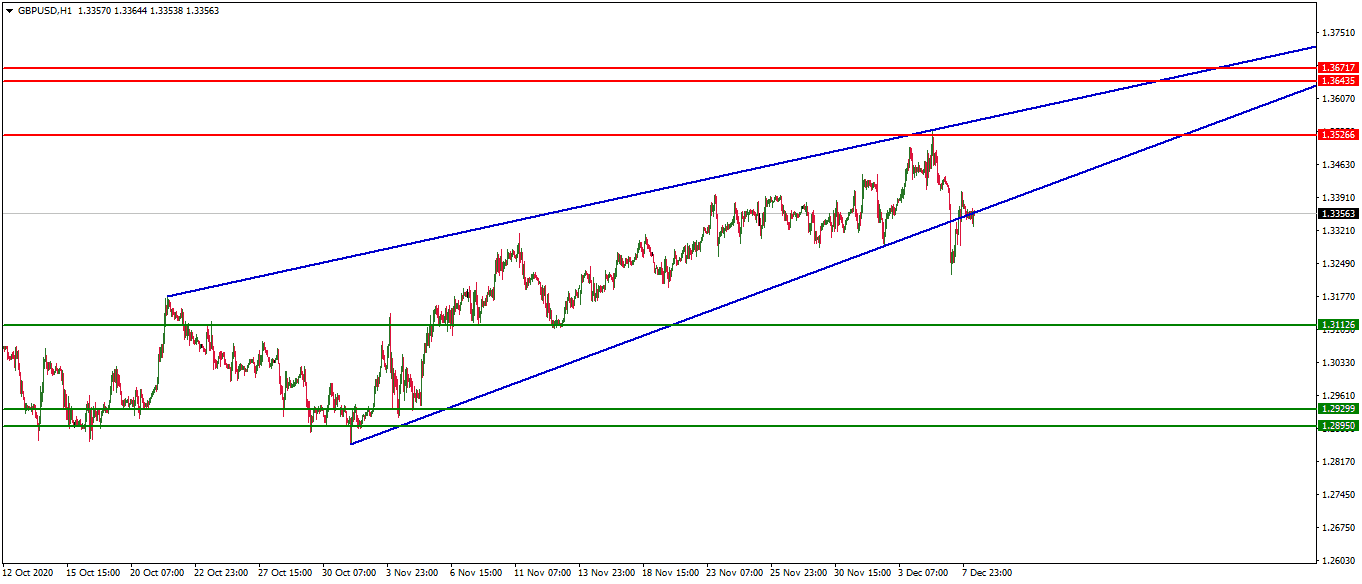

The best short ideas today are from the following levels: 1.3526, 1.3643 and 1.3671.

Stop losses in the short strategy should be placed specifically at the 1.3681 level.

Collect profits on an average of 30 to 50 pips from each level.

Stop loss is moved to the entry point when making 20 pips in profit.

Long Trade Ideas

The best long trade today is from the following levels: 1.3112, 1.2929 and 1.2895.

Stop losses in the long strategy should be placed at the 1.2885 level.

Collect profits on an average of 30 to 50 pips from each level.

Stop loss is moved to the entry point when making 20 pips in profit.

Money Management Strategy

Use 1% to 2% of your portfolio value for all trades and distribute this percentage on the stop loss points.

GBP/USD Technical Analysis

The GBP/USD dropped yesterday far more than expected, which led to the activation of the stop losses of buy signals. The pair breached the lower boundaries of the price channel and closed below it, forming the broken trend pattern. It then rose again to test the broken trend, which leads us to believe in the possibility of a drop to target lower levels this week.

During the coming days of December, the pair is expected to start trading within strong price movements.

Best intraday short levels are considered at 1.3526, 1.3643, 1.3671

Best intraday long levels are considered at 1.3112, 1.2929, 1.2895

GBP/USD Fundamental analysis

Today, the British pound is not expecting any important economic data. The USD will be expecting the following:

At 3:00 pm KSA time, a US report will be issued regarding the short-term energy forecasts issued by the US Energy Information Administration, The monthly report provides forecasts extending to the end of the following year about the consumption of major fuels, their supply, volume and prices. The report also provides an in-depth analysis of the crude oil, petroleum products and natural gas markets.