For the second day in a row, the GBP/USD is moving in an upward momentum which pushed it towards the 1.3562 resistance. This came after news reports that the European Union and the United Kingdom have reached the outlines of a trade agreement after Brexit. As Bloomberg reported, "The negotiators are still finalizing the agreement, the officials said, who spoke on condition of anonymity." Others warned that the deal is not over yet, and that any announcement may be a few hours away.

A number of journalists who have contacts close to the negotiations had previously reported that a deal could be agreed on today, but a recent point of disagreement over battery imports had impeded progress. Harry Cole and Nick Gottridge - two journalists with a proven track record of providing reliable informal briefings - both say that the Brexit deal is "looming" on the horizon today, but that "a strange last-minute dispute over batteries" prevents handshakes.

The battery issue appears to be related to the import of electric vehicle batteries, a sector that will be of great importance in the coming years given the commitment of the United Kingdom and the European Union to phase out combustion engines. According to several media sources, the European Union Commission has asked member states to prepare for the meeting this morning if an agreement is signed, which could boost hopes of reaching an agreement within hours.

"It looks like the deal is very much in place," an EU diplomat told Reuters. "It is a matter of announcing it today or tomorrow." The diplomat added that the European Council, which represents the member states in Brussels, has begun preparations to enable this so called “provisional implementation” which is a speedy implementation of the agreement.

Also, media reports said earlier that negotiators will continue trying to reach a final compromise on fisheries and equal opportunities during the day, with the aim of reaching an agreement today, December 24th.

Commenting on the sterling’s performance in light of these reports, Derek Halbene, Head of Research, Global Markets at MUFG said: “The pound sterling is rising as hopes for progress have been raised again and the announcement could come as soon as tonight. With many of the problems now resolved according to reports from Brussels, it appears that bargaining over fishing still needs to be agreed. If these reports are correct, then it is certain at this stage that the positive result is more likely."

If no agreement is reached by December 24, the talks are expected to continue after Christmas.

Accordingly, the pound is likely to remain volatile as long as talks are ongoing and informal briefings are being presented, but major directional moves are likely to be either higher or lower than is likely only once the end result is known. The developments come at a difficult time for the British economy, which has seen many companies shut down again as the government tries to stop the spread of SARS-CoV-2. A new strain of the virus has led to many countries closing their borders to the United Kingdom, although many European Union countries will begin to reopen their borders to citizens returning from Britain.

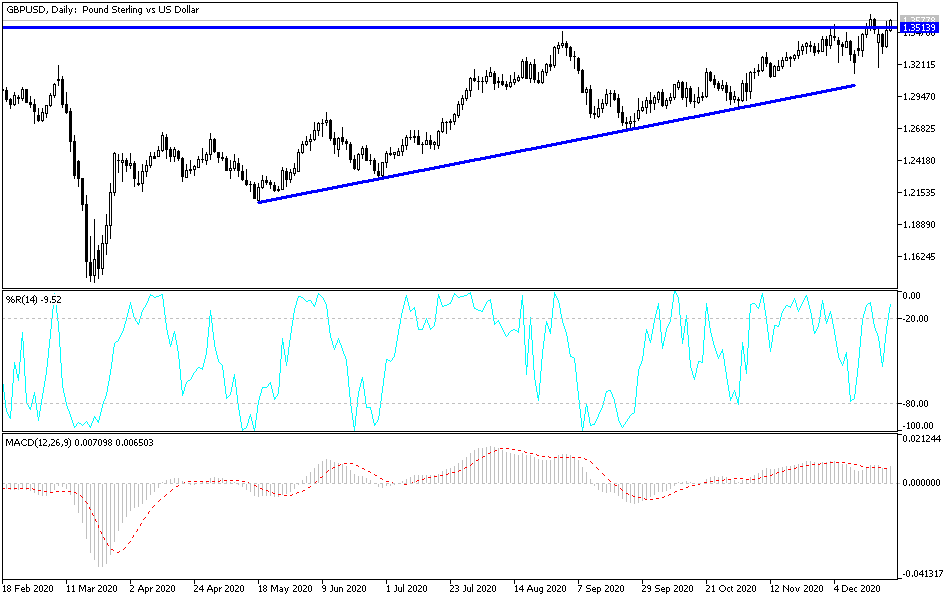

Technical analysis of the pair:

As I mentioned before, GBP/USD breaking the 1.3500 resistance level will stimulate the bulls to continuously control the performance and thus move towards stronger bullish levels. If a Brexit agreement is announced at any moment, we may witness strong price gaps for the pound, and in the case of this pair, we do not exclude the 1.4000 psychological resistance, and then the focus will be on the economic situation and the path of the coronavirus.

The opposite will be true if the agreement fails: the pair will witness a downward price gap. In general, it is better to wait for the announcement of the final results of the Brexit negotiations and not to rely on any expectations for the negotiations, especially since the markets are on the verge of closing, and things may not move as desired.

With the economic calendar today being empty of any important and influencing data, Brexit developments will be the main driver for the pair.