Despite the market’s concern about a new failure in the Brexit negotiations, the GBP/USD currency pair succeeded in pushing up to the 1.3540 resistance. This was the pair's highest level since May 2018, and it closed last week's session flat around the 1.3435 level. The week’s performance was in a fluctuating range. Severe instability is due to the divergent statements of the European Union and Britain regarding the failure or chance of success in reaching a trade agreement between them. Investors' desire to take risks at the expense of the safe-haven US dollar was an important factor in achieving these gains.

Brexit talks have stalled due to a row over the fishing industry. It is the point that disrupted the trade agreement between the European Union and Britain, putting hundreds of thousands of jobs at risk and tens of billions of euros in annual production losses. While fishing is an insignificant part of the nations' economies, it is an important national point of pride for coastal and island states and has an enormous influence on politics. Nigel Farage, Arch-Brexiteer, placed so much of the importance on fishing that at some point during his successful 2016 campaign to get Britain out of the European Union, he entered the Thames on a fishing boat.

Sir Evan Rogers, a former professional diplomat and long-time UK representative at the EU headquarters in Brussels, knows what the mission of British Prime Minister Boris Johnson is during the last weeks before the January 1 deadline. "He has to win on the fisheries issue," Rogers told a panel at the EPC think tank this week. If Johnson cannot expel enough EU fishing boats from UK waters, a Brexit without a deal is sure to create chaos and costs for everyone and destruction for some.

UK ships landed nearly 1 billion pounds worth of fish last year. The gross domestic product of the United Kingdom last year was 2.17 trillion pounds. France, the Netherlands, Belgium, Ireland and Denmark are among those directly involved in the possibility of closing the UK's waters.

For centuries, foreign fishermen shared the abundant waters off Britain, and it was no different since the United Kingdom joined the European Union in 1973. But with catches dwindling, sometimes to a fraction of their previous numbers due to brutal overexploitation, the number of British fishermen has dwindled from 22,000 in 1975 to 12,000 in 2018. Discontent has increased in UK fishing communities. No one can deny Britain's rights to its waters in theory, but it is not so simple. Although Brexit left the bloc in a much weaker position, UK exports gave it leverage.

Commenting on the fishing file, a senior diplomat from an EU country said, "If they don't allow our boats to enter, they can eat all the fish they catch themselves." About 80% of the fish landed in the UK is exported, three quarters of which goes to the European Union. If the continent closes its markets, fish will rot on British docks.

The points of contention between the European Union and Britain are many, time is running out, and there are only a few days until the end of the transition period.

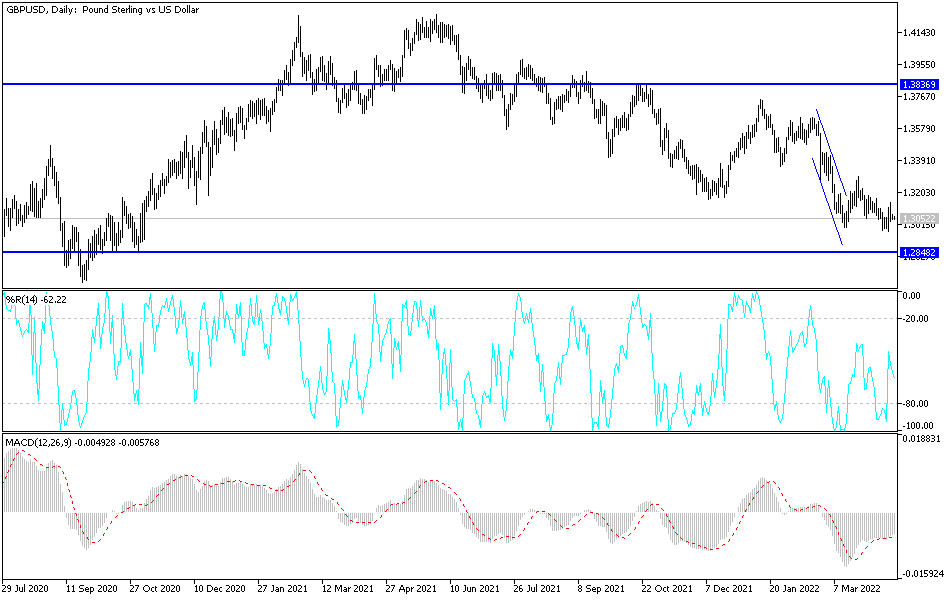

Technical analysis of the pair:

The pound’s performance will continue to witness a state of instability against the rest of other major currencies until the official and final announcement of the path of negotiations. So far, the general trend of the GBP/USD pair remains bullish and breaking the 1.3500 resistance is important and symbolic for the bulls to control the performance. Stability above this level heralds a stronger upward movement. On the downside, the important first bear station will be 1.3250, and breaking below that will increase the bearish expectations for the 1.3000 psychological support again.

The currency pair does not expect any important or influential economic data releases from Britain or the United States of America, and investor’s risk appetite, along with statements concerning the Brexit file, will have strong and direct influence on the pair’s performance.