Ahead of the Bank of England's announcement of its monetary policy decisions on Thursday, the GBP/USD currency pair is benefiting from investor risk appetite and the dollar’s collapse. These factors allowed the pair to achieve stronger gains, pushing it to the 1.3564 resistance, its highest level since May 2018. These gains come at a crucial time, as financial markets wait with caution and pessimism regarding the possibility of a Brexit trade agreement between the European Union and Britain.

The performance of the pound is affected by the stalled Brexit negotiations, COVID-19 restrictions and the continued stimulation of the British economy which is stalled in the face of the pandemic. So, a flurry of recent proposals to raise revenue for the government will be an attack on wealth, say Director Frank Hearth and Michael Lewis, a specialist tax advisor in the UK and US. Lewis believes the UK government can announce changes to the capital gains tax starting April 6.

When the UK Treasury addresses the nation with its coronavirus recovery plan, one might be forgiven for asking how it will pay for it all. The UK is expected to borrow a total of 394 billion pounds this year, equivalent to 19 percent of its GDP. All in all, an astonishing amount of debt needs to be serviced. The recently announced public sector pay freeze, along with previously announced changes to pensions, will help bridge the gap.

There was a surprise in some quarters, though, that the chancellor had not enacted the OTS's proposals on capital gains tax (CGT) that it had requested only a few months ago.

The pound extended its gains in the Forex market amid media reports that the post-Brexit trade deal was close to completion. The contents of the briefing given by European Commission President Ursula von der Leyen to the European Parliament saw positive momentum for the British pound, but reports that negotiations are still pending on fisheries, meaning that the deal is still not achievable. Von der Leyen told the European Parliament that "the good news is that we have found a way forward on most issues."

Among positive news for sterling, BBC Newsnight Political Editor Nicholas Watt says: “There is a last-hour buzz among Conservative MPs that the UK is heading towards a Brexit deal with the European Union. Skeptics in Europe have been reassured that they will be happy." It was also widely reported that Parliament was preparing to sit down during the Christmas break. According to plans being examined by Speaker of the House of Commons Jacob Reiss-Mog, MPs and peers will be asked to sit down on Monday, Tuesday and Wednesday of next week if an agreement is not reached by the end of the week, The Telegraph reported.

Commenting on this, Simon Harvey, a Forex market analyst at Monex Europe, said: “The rally in the British pound seems to have received more support from the headlines indicating that the parliamentary session is to be extended to next week in order to discuss a trade deal with the European Union and possibly ratify on her".

Bruno Waterfield of The Times says: “There is nothing imminent about Brexit, and according to sources, both sides are certain that nothing will happen right away, and the deal is still not there even though the next few days involve the possibility that this will happen." Also, Adam Parsons of Sky News said: "I know Westminster is apparently talking about an imminent Brexit deal, but ... I haven't heard anyone say that among Brussels diplomats."

Technical analysis of the pair:

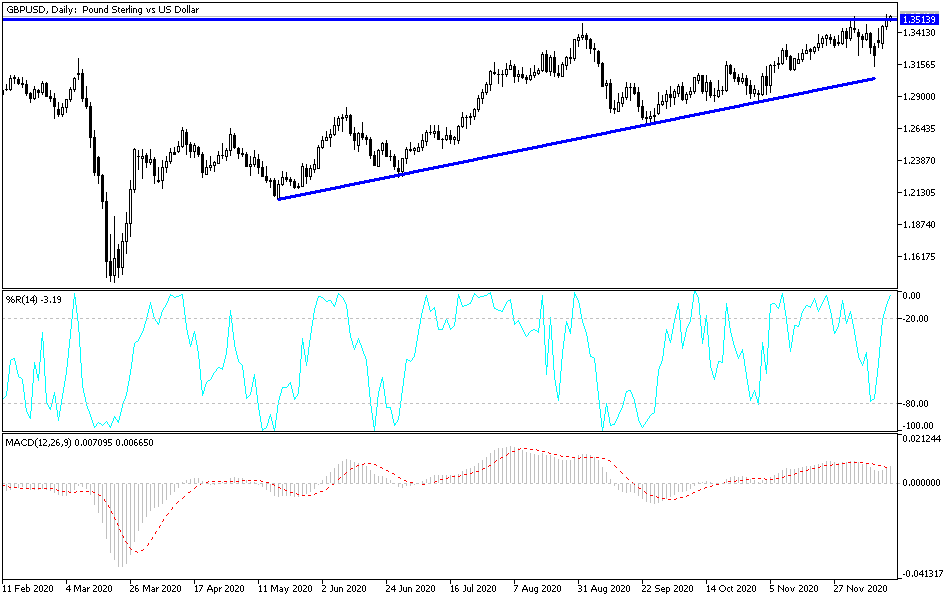

So far, and according to the performance on the daily chart below, the GBP/USD pair is moving within a strong bullish channel. There is a clear disregard for the technical indicators moving into strong overbought areas, and the sterling will maintain its gains until the final announcement on Brexit. So far, the markets are pricing in the possibility of reaching an agreement. Therefore, do not be surprised that if an agreement is reached, sterling will not achieve much more, as the investor's view will then shift to the economic performance in the era of corona. So far, the closest targets for the bulls are 1.3585, 1.3630 and 1.3700, respectively.

On the downside, according to the performance on the daily chart, a break below the 1.3365 support will have a negative impact on the current performance.

Today's economic calendar:

For the GBP, focus will be on the announcement of the Bank of England's monetary policy decisions. For the USD, data releases will include the housing market numbers, building permits and housing starts, then reading the Philadelphia Industrial Index and the weekly jobless claims.