After any drop in the GBP/USD currency pair, Forex traders begin to think about buying. With the relative return to trading in the markets, the pound sterling has fallen by 1% against the euro and three quarters of a percent against the US dollar since the E.U. and U.K. announced a free trade partnership after Brexit. The currency pair retreated to the 1.3429 support, but amid optimistic buying due to the long-awaited agreement, the currency pair shot up towards the 1.3556 resistance, where it is close to as of this writing. The markets were already pricing in a last-minute Brexit agreement, as each party wants to obtain the maximum number of advantages that will affect them in the future.

Commenting on the performance, Charles Porter of SGM Foreign Exchange Ltd. Said: “The Forex markets have started their first correct trading day and are safe in the knowledge that the UK will conclude a trade deal above WTO standards with respect to the 27th European Union on January 1st. So far, there has not been a significant sign evident within the pound, but it is clear that, in conjunction with Trump's signing of a fiscal stimulus bill to prevent the US government shutdown, markets are adopting less defensive conditions.”

Commenting on the outlook for the sterling after the last deal, Gavin Friend, chief strategic analyst at NAB in London, said: “We have consistently believed that the deal will take place, and since late July, we have projected the $1.36 level for the end of December. We expect the GBP/USD pair to move above the 1.40 high in 2021, and in our latest foreign exchange update, there is an expected 1.42 level for the GBP/USD by the end of the first quarter of 2021." Also, NAB expects the exchange rate of the GBP/EUR to trade around 1.1495 in 2021.

Another reason why the British pound has not appreciated strongly against the euro is that the UK will see some negative economic impact from its decision to leave the European Union. The British Independent Office of Budget Responsibility projected that the UK would see a 4% loss in the economy over fifteen years, more than it would have been if the UK had stayed in the European Union. The true extent of any production loss will become clearer over time and after the initial euphoria of the deal has faded. The UK is, after all, a service-based economy and this deal is often - though not exclusive - important to commodities.

Given the recent price action in the British pound and the expectations of NAB - and many other analysts - for a currency rally in 2021, it appears that any rally in the sterling could be slow. On Monday, EU ambassadors provisionally approved the free trade agreement as the European Parliament is unable to convene to put the agreement into effect before December 31.

Meanwhile, the UK parliament is expected to endorse the deal this week as there has been very limited criticism of the deal from Prime Minister Boris Johnson's Tory Party, with the opposing Labour Party saying they would support the deal. While the deal agreed to by the European Union and the United Kingdom would ensure “no customs duties and quotas on all goods that conform to the appropriate rules of origin", trade in services - which accounts for more than 70% of Britain's economic output - is not fully covered by that deal.

The deal itself is a hard form of Brexit and provides for exemptions from tariffs (and limits lofty non-tariff barriers too) trade only. The deal does not cover services, including financial services. Nor does the deal attempt to preserve elements of a customs union and a single market that supports economic growth.

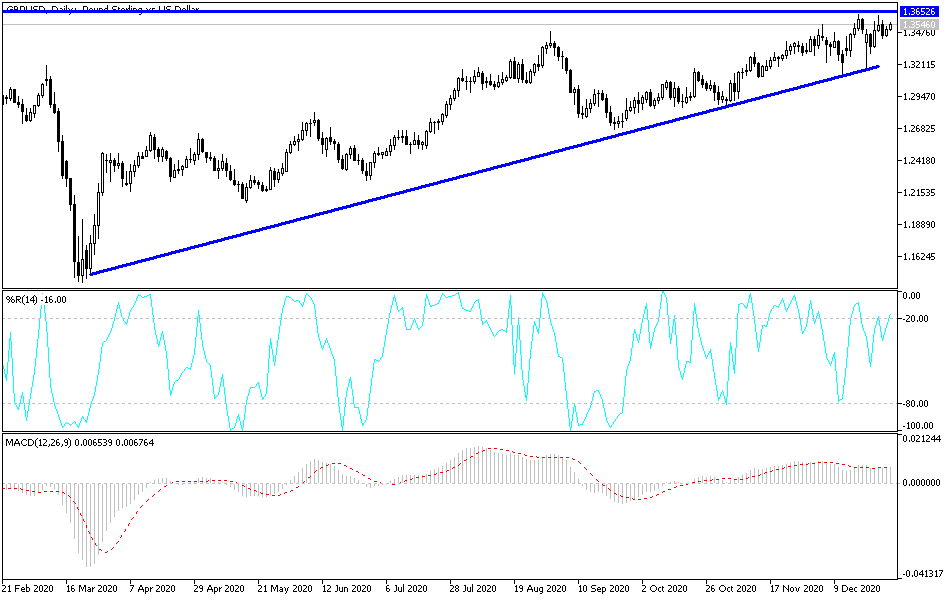

Technical analysis of the pair:

The GBP/USD trend direction is still upward, and after the approval of the Brexit deal, any decline in the currency pair may be an opportunity for Forex investors to return to buying. The closest support levels for the currency pair are currently at 1.3490, 1.3400 and 1.3325, respectively. After the storm of the Brexit deal has ended, we are now monitoring the containment of new coronavirus strains and thus the return of economic restrictions, which explains the recent stopping of sterling's gains. To the upside, as I mentioned before, the stability of the currency pair above the 1.3500 resistance will continue to support the bulls' domination.

There is no significant UK economic data today, and from the US, the commodity trade balance, pending home sales and Chicago PMI data will be released.