Cautious anticipation amid pessimistic expectations regarding Brexit pervades the GBP/USD currency pair today. Since the beginning of trading this week, the pair has been in a state of instability with a greater bearish tendency. The GBP/USD stabilized around 1.3355 at the time of this writing after a positive start to this week around the 1.3445 resistance. Despite pessimism about Brexit negotiations, the sterling got some support, as did the British economy this week when the ball started rolling on the global vaccination program against the coronavirus. However, the British economic recovery could be halted if the British Treasury’s concerns about the budget deficit lead to an unnecessary or early return to austerity.

Currently, the coronavirus vaccine from Pfizer and BioNTech is being provided gradually and is expected to continue more in the coming months. This is prompting the government to ease its demands for social distancing and related restrictions on activities that came at a high price for companies, individuals, and the economy. Vaccines, if effective, could reduce the risk of overburdening health services and enable normal life to resume, leading to a return to normal production from industries and spending between consumers and households.

“At some point, financial pressure may be needed to drive any permanent increase in spending due to the COVID-19 crisis and age-related increases in spending,” said Ruth Gregory, Chief Economist at Capital Economics. “But the greater risk is that fiscal policy is tightening too much too soon to close the observed fiscal gap that never materialized, which could be self-determination because it would lead to a slower economic recovery."

Gregory and the Capital Economics team warned on Tuesday that "long-term scars" would result from any premature decision by Britain's Treasury to withdraw pandemic-related support programs or begin further cuts in public spending, which could jeopardize businesses and jobs and may require even bigger discounts in the future.

The spending review in November came just days after the Office for National Statistics announced that the British government had borrowed 22.3 billion pounds, an amount equal to more than one percent of its GDP in the previous month in October, and that borrowing for the first seven months of the fiscal year reached 214.9 billion pounds, up 74% from the 2019 level.

European Commission President Ursula von der Leyen and British Prime Minister Boris Johnson gave their respective sides of the Brexit negotiations until Sunday to end four years of diplomatic acidity and salvage trade deals after the UK voted to leave the European Union in 2016. Otherwise, they face a turbulent split without a deal at the end of the month, threatening hundreds of thousands of jobs and billions in losses. Even after two lengthy phone calls and a three-hour dinner in less than a week, there is still much under contention.

Johnson traveled to Brussels hoping to inject new momentum into the pending talks on issues including fishing rights and competition rules.

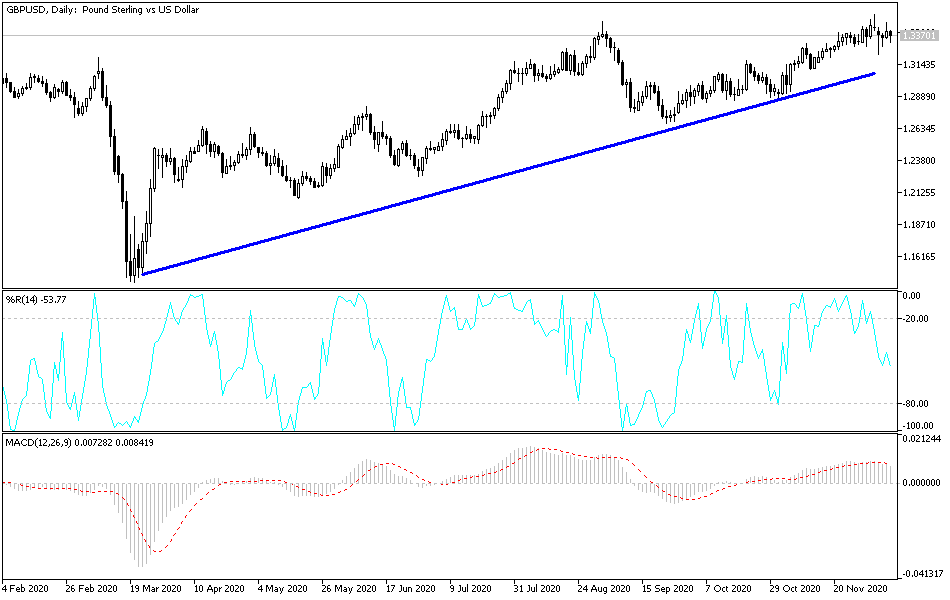

Technical analysis of the pair:

After recent GBP/USD gains, which pushed technical indicators into overbought areas, and with the absence of a positive development in the Brexit negotiations, there was an opportunity for profit-taking operations. This relative stability around the top of the resistance at 1.3300 still supports the bulls' control over performance. The pair is in a waiting position for any developments in the Brexit negotiations, and there will be no real reversal of the current bullish trend without the pair breaking below the 1.3100 support. On the upside, the 1.3500 resistance remains an important symbol of bulls' control, and there will be no overcoming it without positive developments in the EU-Britain negotiations.

Today's economic calendar:

In the U.K., the rate of industrial production, the growth rate of GDP and the trade balance of goods will be announced. In the U.S., the Consumer Price Index and unemployment claims will be announced.