The GBP/USD currency pair fell at the beginning of this week's trading to the 1.3430 support, before stabilizing around the 1.3482 level as of this writing. The markets have already priced in a trade deal between the E.U. and U.K., and after the official announcement of reaching an agreement, the attention of investors and markets will turn to the damage from the new strains of coronavirus and how to contain it. Profit-taking sales were expected, and in the midst of European competition to obtain and produce vaccines, the E.U. will lose the vaccine race to the U.K. and the U.S. despite the development of the first effective vaccine on German soil. But establishing a one-size-fits-all policy will always be slower than its peers.

Britain notified the World Health Organization last week that a separate, more contagious strain of coronavirus had been found and spread in the United Kingdom, prompting more than 40 countries to ban flights from Britain. After that, new strains of coronavirus were discovered in the Netherlands and other European countries as well. This may mean that it is only a matter of time before Europe faces the new travel restrictions, which have a major influence on the currency market.

The GBP/USD exchange rate is still on its way to end 2020 trading around its highest levels after the referendum, as the Brexit deal created a new era in relations between the United Kingdom and Europe, while the European currencies could be isolated from any repercussions related to the uncertainty about the US stimulus bill. British Prime Minister Boris Johnson and his allies have been keen to stress that "the war is over", since victory was declared by Brussels last week after more than four years of negotiations, which resulted in the non-imposition of tariffs and zero-share trade amid an agreement accompanied by some major concessions from both sides.

The agreement contains terms of termination as well as a review that enables it to be reviewed in whole or in part every five years. This makes it a platform on which supporters of Brexit can build, and MPs will begin voting on the agreement this Wednesday, and some Brexit supporters have already indicated that they will give their stamp of approval, which means that the parliamentary battles that marred Theresa May's short time in office is unlikely to be the case. Meanwhile, European leaders gave their approval for the interim implementation of the deal to ensure a smooth exit from the Brexit transition period at 23:50 on Thursday.

As a result, positive expectations increased for the GBP/USD performance in the coming period, as some analysts see the possibility of a rise to the 1.3700 top.

As far as what is expected for the sterling in the coming period, Tim Riddle, Forex analyst at Westpac in London, said: "The British pound is likely to gain further. It is likely to push the GBP/USD pair into the 1.37-1.40 range."

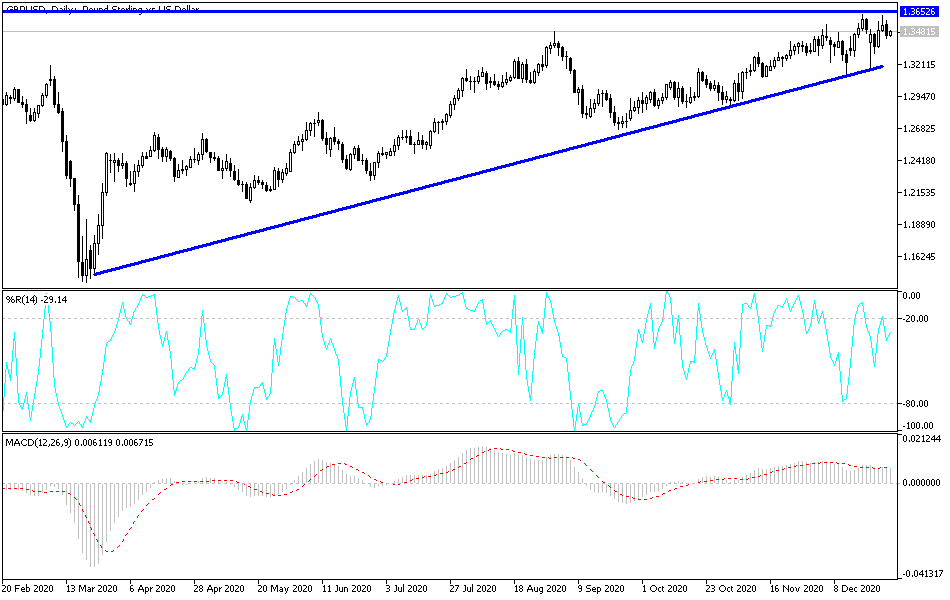

Technical analysis of the pair:

Technical expectations for the GBP/USD performance are still bullish and the bulls' control will remain stronger as long as it is stable around and above the 1.3500 resistance. Accordingly, after agreeing on a Brexit deal, any decline in the currency pair will stimulate Forex investors to consider buying. So far, the closest support levels are 1.3410, 1.3330 and 1.3245, respectively. On the bullish side, the momentum still indicates that the currency pair is ready to make bullish breakouts, especially if fears of an outbreak of new strains of coronavirus subside, and the recent European restrictions start easing.