Instability with a downward tendency is what recently characterized the GBP/USD performance. At the beginning of this week's trading, the pair was subjected to sell-offs, as trade negotiations between the European Union and Britain faltered. The pair quickly rushed towards the support level at 1.3224 before rebounding back up on the threshold of the 1.3400 resistance, amid the wave of risk appetite following the announcements of coronavirus vaccines and their distribution. The pair is stable around the 1.3380 level at the time of this writing, awaiting any updates regarding the stalled Brexit negotiations. The latest development has been an announcement by the Vice President of the European Commission, Marus Sivkovic, and British Cabinet Minister Michael Gove that they had reached an "agreement in principle on all issues" regarding the implementation of the European Union withdrawal agreement, including the protocol for Ireland and Northern Ireland.

British Prime Minister Boris Johnson will travel to Brussels this week to meet with European Commission President Ursula von der Leyen in a last-ditch effort to salvage Brexit talks. According to media reports, there are still major disputes regarding fishing rights, fair trade rules and enforcement mechanism for regulatory standards.

The UK has started giving the first doses of the Pfizer/BioNTech vaccine. People over the age of 80, frontline healthcare workers, homecare staff and residents have been given top priority to get the vaccine.

In general, the pound is expected to decline sharply if the European Union and the United Kingdom fail to agree on a post-Brexit trade agreement, as one analyst said that the decline could see the GBP/EUR exchange rate drop below par. Forex traders are keeping the pound in a hold while they await the outcome of a meeting between British Prime Minister Boris Johnson and European Commission President Ursula von der Leyen.

The meeting will take place in Brussels sometime this week, with political commentators and analysts saying it will likely take place on Wednesday, the day before European Union leaders meet at the European Council summit. The majority of Forex analysts agree that the pound will rise if an agreement is reached, but will decline if the talks end in failure.

However, the upside potential is much smaller than the downside based on options market data.

"There are much more downside risks to the pound than to the upside," says Thomas Pugh, a British economist at Capital Economics. Also, Francesco Bisol, Forex Strategist at ING Bank says, “We believe that the UK/EU trade deal remains the most likely outcome of the talks, which should lead to an eventual but modest recovery in the British pound. We repeat what we see as the sterling's asymmetric reaction to the outcome of trade negotiations between the United Kingdom and the European Union, adding there is a modest upward trend in the event of a deal but there is a deep downside in the absence of a deal as the somewhat limited risk premium is currently priced in the pound."

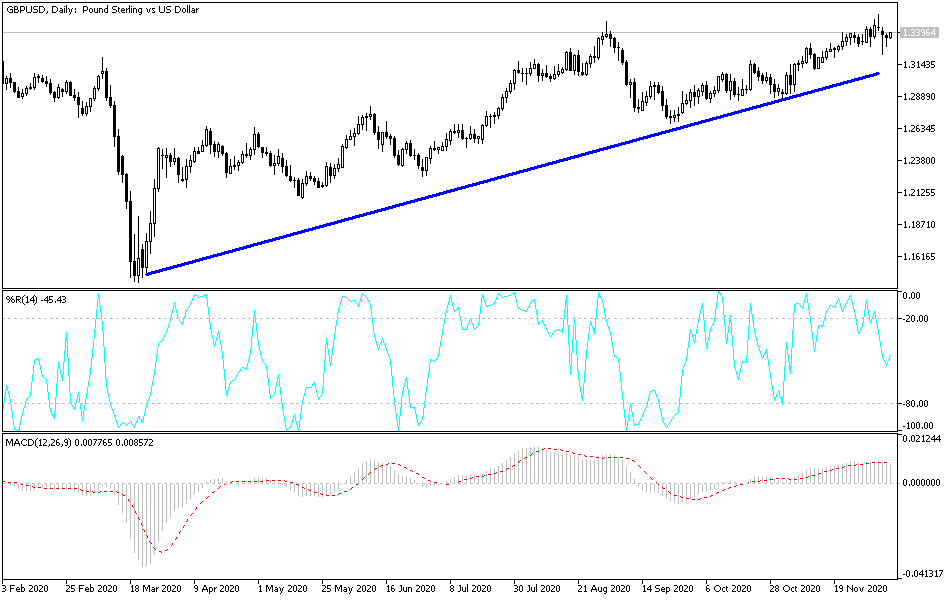

Technical analysis of the pair:

Despite Brexit fears, the GBP/USD is still in an upward correction supported by the USD drop to its lowest level in more than two years, along with investors' risk appetite with the start of coronavirus vaccination. Stability above the 1.3400 resistance, as the situation is now, supports the move towards stronger resistance levels, and the closest ones are currently 1.3475, 1.3535 and 1.3640, respectively. The pair will not care much about gains, as the technical indicators reach overbought areas, as much as it will be concerned with developments on the ground regarding Brexit. Therefore, we have to wait. On the downside, as is the performance on the daily chart, the support at 1.3100 will be the first stop for the bears to re-control the performance.