As fears of a no-deal Brexit increased, so did the pound's losses against the rest of other major currencies. The GBP/USD collapsed to the 1.3224 support at the beginning of this week's trading, after bullish gains supported by risk appetite in global financial markets reached the 1.3539 resistance at the end of last week’s trading, the highest level since May 2018. The pound is subject to more volatility and instability in response to any statements about Brexit. The Brexit negotiations are characterized by constant disagreement and the failure to reach a final agreement after marathon rounds that exhausted the two negotiating teams.

The GBP/USD pair quickly rose to the 1.3400 resistance level again, after news that British Prime Minister Boris Johnson travelled to Brussels to try to secure a post-Brexit trade deal. It was announced late on Monday that Johnson would try to reach an agreement with European Union Commission President Ursula von der Leyen, a move that amounts to a clear escalation of tempo. "We have agreed that the terms for finalizing the agreement are not in place due to the significant differences remaining on three critical issues: equal opportunity, governance and fisheries,” the leaders said in a statement after a phone conversation. "We asked the main negotiators and their teams to prepare an overview of the remaining differences for discussion in an actual meeting in Brussels in the coming days."

The announcement of an actual meeting was a surprise to the markets as the two sides were only expected to try and make headway over the phone. The two leaders spoke on the phone at 4 PM UK time, before Johnson requested to pause the call, likely to speak with advisers. It was always expected that a solution to the stalled talks would be found only at the political level, and it now appears that this is the level at which the negotiations have intensified.

This is a sign that appears to have calmed market concerns, with the pound recovering from losses of more than 1.0% against both the euro and the USD at the beginning of the week’s trading. After news of Johnson's trip to Brussels, the EUR/GBP exchange rate rebounded again above 1.10, and the GBP/USD returned to 1.34.

The Sun reported on Monday morning that Johnson was prepared to walk away from the negotiations "within hours" because the demands put forward by the European Union were "outrageous". Johnson was quoted as saying: “They are really final matters now,” and if there is no movement with Monday's close, there will at least be a question whether it is worth continuing. He added by saying that “we will not give in to European Union demands that prevent us from regaining control over the rules under which the British live."

Therefore, the volatility rate in the British currency performance is likely to increase this week, as investors and automated trading algorithms are likely to react to rumours, briefings and official updates on trade talks status after Brexit that may result in a positive breakout or end in failure over the weekend. On the other hand, Michel Barnier, chief negotiator for the European Union, assured EU ambassadors earlier on Monday that the three outstanding issues related to fisheries, equal opportunity rules and governance remained unresolved.

Media reported that Barnier is pessimistic about the prospects of a deal.

The talks are likely to continue now until the European Council meeting on Thursday and Friday, when EU leaders can agree among themselves on a final proposal to be submitted to the United Kingdom. Therefore, there is still time left to strike a deal, and as a result, Forex traders are not ready yet for a hard selling of the British pound.

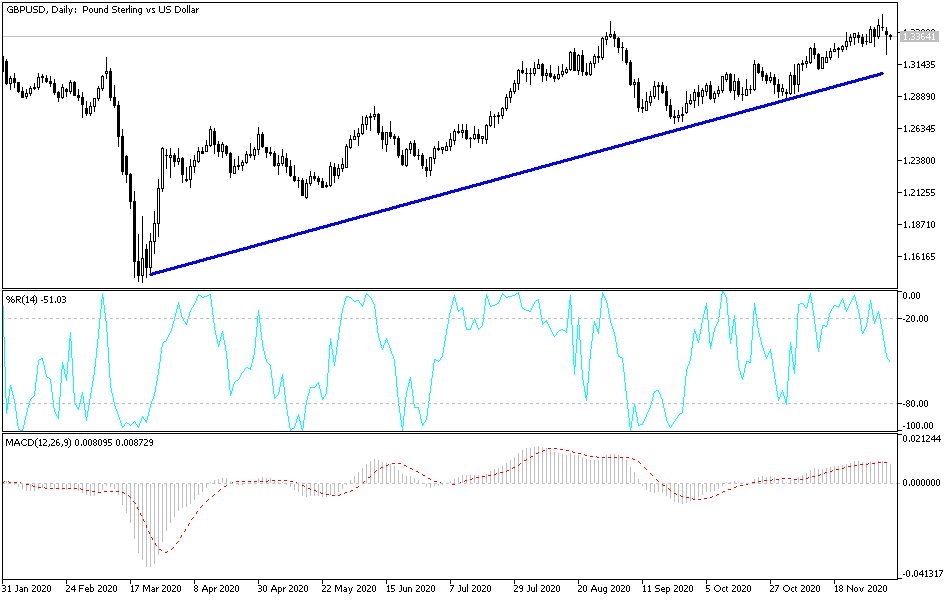

Technical analysis of the pair:

Despite recent GBP/USD performance, the general trend on the daily chart still points to the possibility of an upward trend, and we repeat the strong warning that the pair is subject to violent movements in either direction based on official statements regarding Brexit negotiations. The return of stability above the 1.3400 resistance will give the bulls enough momentum to rush towards higher highs, which are currently closer to 1.3485, 1.3560 and 1.3700, respectively. Any pessimistic hints about the possibility of reaching a Brexit deal will increase selling, so we do not rule out reaching the 1.3000 psychological support and lower again. So far I still prefer to sell the pair with no risk.

Today's economic calendar:

There are no significant British economic releases for the second day in a row. From the United States, the non-farm productivity rate and the Cost of Employment Index will be released.