GBP/USD gains may collide with concerns over possible failure in the Brexit negotiations at a very crucial time. The pair's gains, which were due to the risk appetite that dominated the markets, reached the 1.3442 resistance, the highest level for the pair in three months. However, with renewed fears of a no-deal Brexit, the pair quickly returned to the support level at 1.3288, before settling around 1.3360 at the beginning of trading on Thursday. Yesterday, unoffical news spread regarding the state of trade talks between the European Union and Britain, giving investors reason to take a more cautious approach to the British pound.

The EUR/GBP exchange rate fell below 1.11 for the first time in three weeks after the chief EU negotiator, Michel Barnier, told EU ambassadors in Brussels that “the deal is pending ... as disagreements remain on the three main issues."

French President Emmanuel Macron also said that he is closely monitoring the Brexit negotiations and will not sign anything that conflicts with France's long-term interests. Accordingly, political commentators say that France is looking to preserve as much access as possible to the UK's fisheries, and there is potential for the talks to collapse if France rejects any deal they believe will seriously harm their fishermen.

It is reported that European countries are pressing Barnier to show them any agreement with the United Kingdom before agreeing to it, amid fears that the chief negotiator for Brexit will give up a lot of ground in the last days of negotiations. Accordingly, an EU source told the Guardian: “Barnier will be asked to pass on the message to the Commission that member states want to pre-check a potential agreement before closing it. Being in the dark makes people nervous.”

Meanwhile, financial media reported that some EU officials were open to extending negotiations until 2021 in recognition of the limited time available to complete the deal, a suggestion that was promptly dropped by a British government spokesperson. In fact, the suite of news reports reveals that little has changed, and the one positive thing to hold on to is that both sides continue to engage.

"There is a lot of hype, there is hardly any signal, the main point is that the two sides are still talking," says Michael Brown, Chief Market Analyst at CaxtonFX.

In general, recent developments ultimately confirm that an agreement is unlikely to be reached this week and the focus now shifts directly to next week's meeting of EU leaders at the European Council summit in December, where a final decision is expected to be reached. Commenting on this, Sharon Bell, a strategist at Goldman Sachs Bank in London says, “While trade talks between the United Kingdom and the European Union have taken longer than originally planned, our economists continue to expect a weak free trade agreement in commodities, and therefore, the European Union Counsel meeting on 10-11 December appears as an achievable goal to see a final agreement, from our point of view. ”

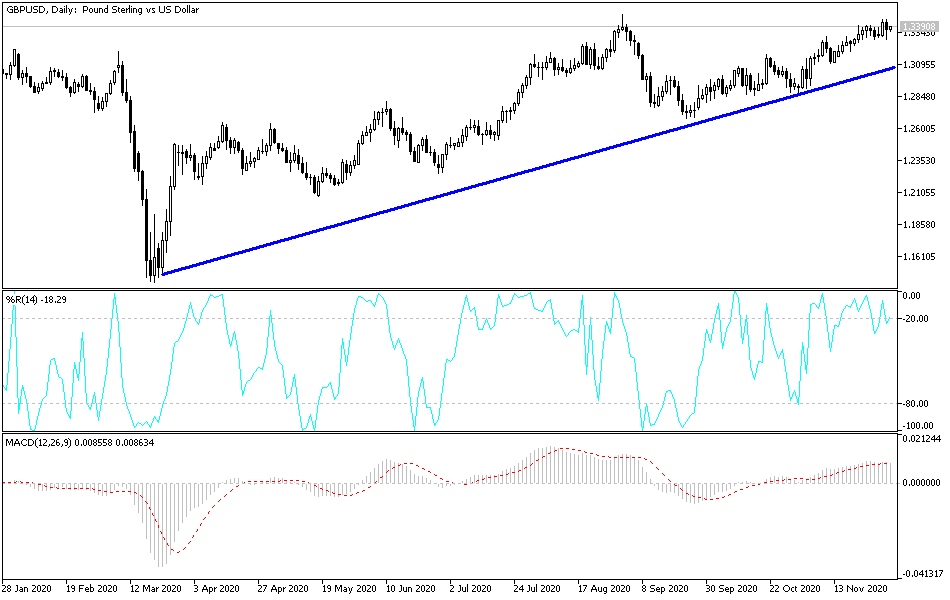

Technical analysis of the pair:

The GBP/USD is subject to more volatility in the Forex market during these crucial days, with Brexit talks approaching their end and informal briefings leading to moves in either direction. Therefore, it is likely that a more substantial move will come only when a formal conclusion is reached. So far, the bulls still have the strongest control and stability above the 1.3400 resistance, confirming and warning of the possibility of moving towards stronger ascending levels, the closest of which are currently at 1.3465, 1.3520 and 1.3600, respectively. On the downside, according to the performance on the daily chart, breaking the 1.3210 support is the most important for bears to re-control performance.

Today's economic calendar:

In the UK, the Industrial Purchasing Managers Index (PMI) reading will be announced, as well as any new issues related to the Brexit negotiations. In the United States, the jobless claims will be announced, and the US services ISM PMI will be read.