The European Union and Britain insisted on continuing Brexit talks despite months of failure, which brought some momentum to the GBP/USD at the beginning of this week's trading. The pair rose to the 1.3445 resistance before retreating to the 1.3309 support in early trading, and stabilized around 1.3345 at the time of this writing, awaiting new developments. In general, as I expected, the strong volatility and instability will continue to dominate the sterling’s performance against the rest of other major currencies until the final announcement of failure or success in reaching an agreement between the European Union and Britain.

For his part, the chief negotiator for the European Union, Michel Barnier, said he still firmly believes that a post-Brexit trade agreement was possible, and reduced the major outstanding disputes that must be settled before the new year to just two. Meanwhile, Britain said that the negotiations now taking place in Brussels could continue for some time and indicated that it does not intend to stop the talks as long as progress is possible.

Barnier also said that the nine-month-long negotiations managed to reach some agreements on fair competition rules and fishing rights, and he no longer mentioned the issue of legal mechanisms for resolving future disputes. "Two conditions have not yet been met," he said while entering a meeting to brief the 27 member states of the European Union on the progress made in the talks. He is expected to continue negotiations with his British counterpart David Frost. "This deal is still possible," he added.

In Britain, Business Minister Alok Sharma said: "The fact that we are continuing to have these discussions shows that there is an opportunity to try to make some progress. Our intention is not to turn away. We will continue talking as long as there is a possibility to reach an agreement,".

The two sides teeter on the brink of a no-deal Brexit, but have made a final push before January 1, when the post-Brexit transition ends on January 31. On Sunday, British Prime Minister Boris Johnson and European Commission President Ursula von der Leyen abandoned the deadline they had set themselves and promised to "go the extra mile" to reach a post-Brexit trade agreement that would avoid a mess and the costs of border trade in the new year.

As for the implications of the current situation, Fabien Zellig, head of the EPC Research Center, said that since traffic jams are already hindering access to trans-canal ports such as Dover in England and Calais in northern France, the time pressure should start to affect London.

In general, the Brexit file continues to strongly affect the pound by more than the results of the British economic data, and this week the pound will be anticipating the Bank of England announcing its monetary policy and some important economic data.

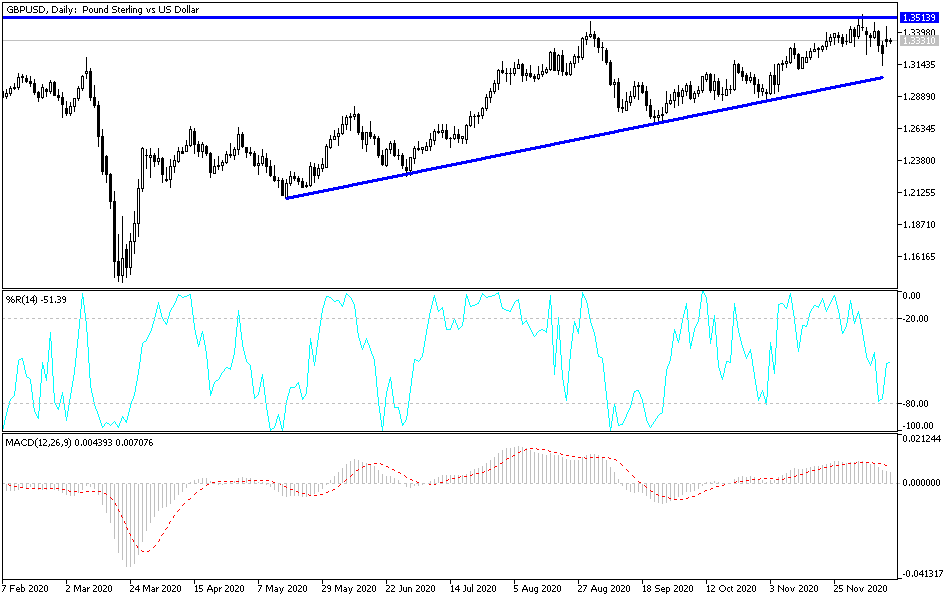

Technical analysis of the pair:

Instability will continue to dominate the performance of the GBP/USD in the remainder of 2020 trading until the final announcement of a post-Brexit agreement, because it will determine the future of the pound in the currency market. The currency pair's proximity to the 1.3400 resistance still supports the bulls' control over the performance and supports the move towards stronger bullish levels, which are currently closer to 1.3385, 1.3445 and 1.3560, respectively. On the downside, there will be no return to bears dominating the performance without moving the pair below the support level at 1.3160.

Today's economic calendar:

In Britain, the average wage, change in employment and unemployment rate will be announced. In the US, the Empire State Industrial Index and the US industrial production rate data will be announced.