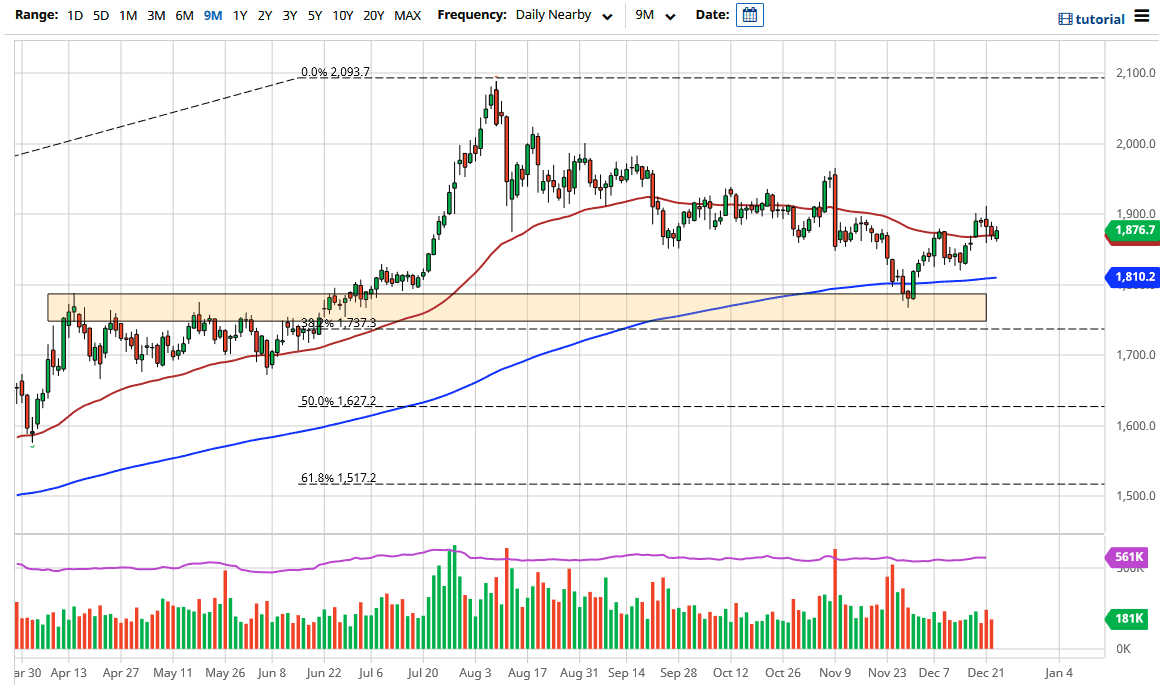

Gold markets rallied during the trading session on Wednesday, breaking above the 50-day EMA yet again. This is a market that has further to go over the longer term, but it may take a bit of patience to realize all the gains that are possible. The United States Congress passing stimulus, and perhaps even adding more to it, should continue to work against the value of the US dollar. That, by extension, can have gold rallying as we continue to see a lot of money flowing out of the greenback. There is also a lot of stimulus coming out of various economies in the world, so gold markets will also rally against other currencies.

To the downside, I see the 200-day EMA as offering support near the $1810 level. The $1800 level in general would also offer support, so there are plenty of reasons to buy dips. Breaking above the $1900 level could open up a move towards the $1950 level, which has seen a lot of selling previously. After that, the market then will go looking towards the $2000 level. This is a market that will see plenty of buyers on dips, and the uptrend should continue for quite some time. I do believe that the US dollar will continue to get hit, which will help the markets in general.

Longer term, most people are looking to try to get away from the quantitative easing and wealth destruction coming out of governments. I have no interest whatsoever in trying to short this market, and I believe that it is only a matter of time before we get to much higher levels. That is not going to be easy, but not only will we have the quantitative easing trade, but we also have the so-called “safety trade” when it comes to the gold market. Keep in mind that the next several days will be very thin as far as liquidity is concerned, so for the next several sessions I would expect somewhat choppy behavior.