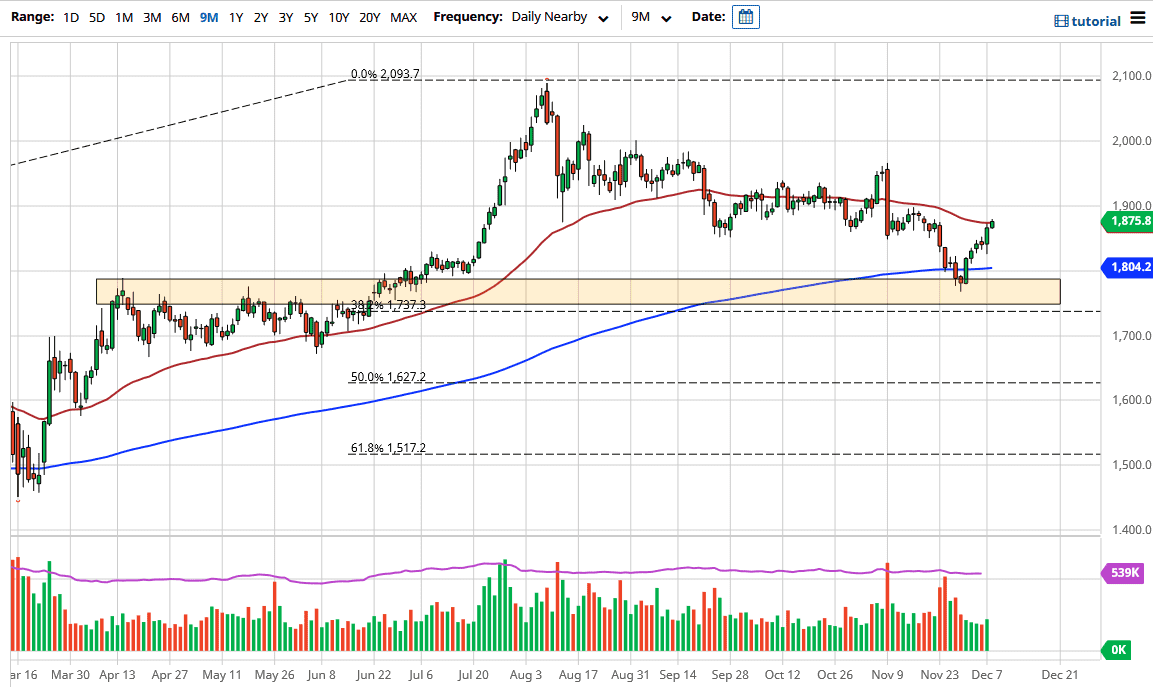

Gold markets rallied a bit during the trading session on Tuesday to break above the 50-day EMA. By doing so, it looks like the market is ready to go higher over the long term. At this point, however, we may continue to see a lot of choppiness and volatility. After all, we have formed a massive “V pattern”, which is very strong but does not necessarily mean that we will go straight up in the air from here. We will mainly be paying attention to the US dollar, which bounced ever so slightly during the trading session on Tuesday. Because of this, we may get a short-term pullback, but that pullback should be a nice buying opportunity.

The 50-day EMA is watched by long-term and intermediate-term traders, so that should continue to cause a bit of a reaction. The candlestick from the trading session on Monday is very impressive, so it might be difficult to break through the bottom of it. I would anticipate that somewhere between here and the bottom of the candlestick we should see buyers coming back in and trying to pick up some value. At this juncture, it is obvious that the 200-day EMA underneath would offer a massive floor as well. In other words, this is a scenario in which you would be looking to pick up bits and pieces of a longer-term position. After all, we had recently seen a major pullback of roughly 20%, but once we got to the 200-day EMA, it seemed to be a bit too much to continue lower.

To the upside, I believe that the $1900 level will be resistance, not only due to some structural noise, but the fact that it is a large, round, psychologically significant figure. Buying the dips will continue to be the best way to get involved in the market, because from a structural, long-term standpoint, with central banks around the world looking to liquefy markets, gold should continue to get a bid due to the USD's decilne and the stimulus which causes major issues by debasing fiat currency.