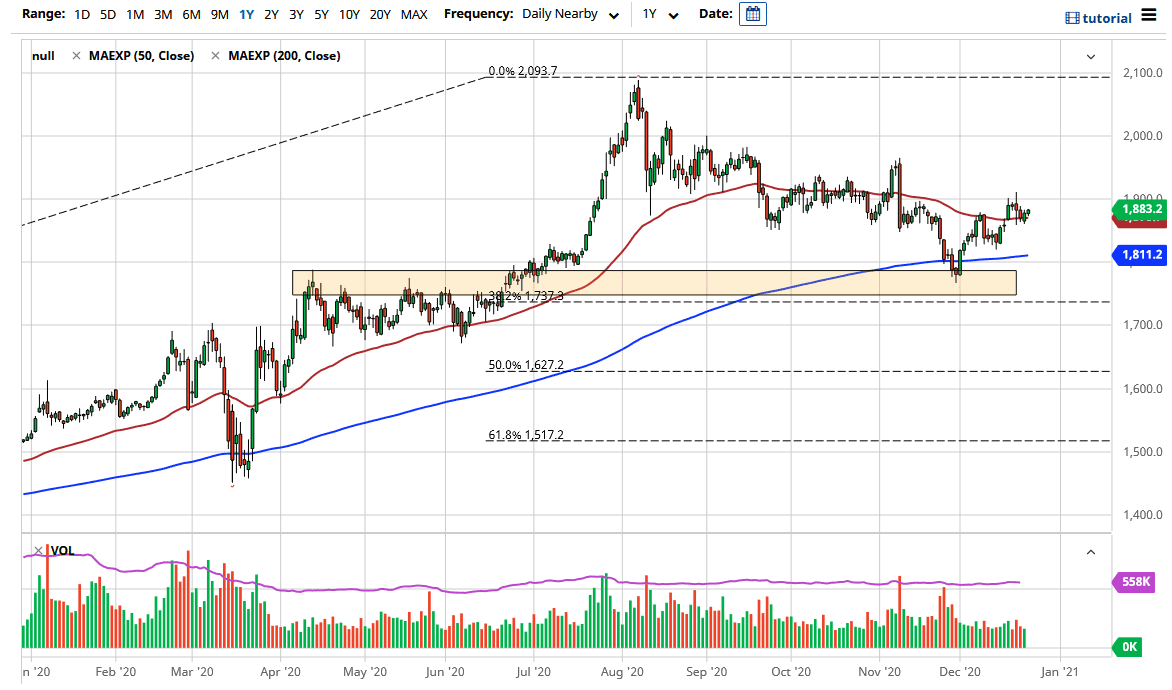

Gold markets rallied during the trading session on Thursday, heading into the Christmas season. This is a market that continues to see a lot of inflows, as there are many people out there who are looking to protect their wealth due to the stimulus devaluing currency. The market is probably going to go looking towards the $1900 level, which is a large, round, psychologically significant figure, and will attract a lot of attention.

The 50-day EMA underneath continues to offer support, so if we break down below there it is likely that we could go down towards the 200-day EMA which is closer to the $1811 level. We had a nice pullback in the gold market up to this point, and it does offer a bit of value. The market has been finding buyers on short-term dips over the last couple of weeks, so we should simply follow this pattern. With stimulus in the United States as well as other economies around the world, I think many people will be trying to take advantage of fiat currency being destroyed.

Looking at the chart, the 50-day EMA is also starting to turn higher, which is a bullish sign. The market will continue to see a lot of noise, but at the end of the day, even though we have fallen as far as we have, the pullback was only to the 38.2% Fibonacci retracement level. It is very likely that we will continue to see gold reach towards the highs again, possibly even higher than that.

If we did break down below the recent low, that means we could open up a move towards the $1700 level, possibly even the $1650 level. That is the least likely of scenarios, but it is only a matter of time before we rally. If you jump into this market in little bits and pieces, then you can build up a longer-term position. We will be very thin over the next several days, so you need to be cautious about jumping into the market with too big of a position.