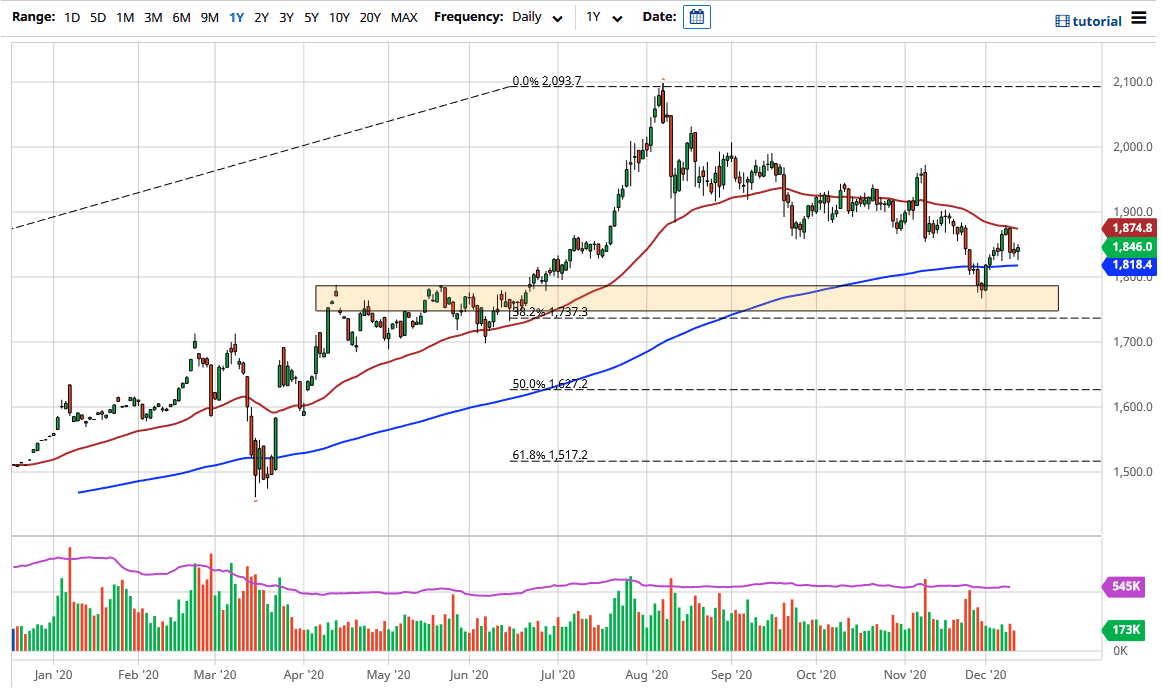

The gold market initially fell during the trading session on Friday to reach down towards the 200-day EMA yet again. This is an area that has been supportive more than once, and the fact that we have turned around to form a hammer suggests that we could go higher. After all, the United States is discussing stimulus, which should show strength in this market. After a stimulus bill is passed, one would think that the greenback will lose strength and, as the gold markets are priced in those greenbacks, it is very likely that we will see the dollar push gold higher for of this reason alone.

Furthermore, central banks around the world are all doing quantitative easing and loosening to bring down the value of fiat currency, as we are in a massive “race to the bottom.” It is therefore likely that the gold market will be favored going forward, and even though we have pulled back a bit when you look at the longer-term trend, we have only pulled back to the 38.2% Fibonacci retracement level.

In the short term, the 50-day EMA is near the $1875 level, and if we can break above there it is likely that we will go looking towards the $1900 level. After that, we could be looking at the $1950 level. Every time we pull back in the gold market, we find people willing to jump in and pick up a bit of gold in order to build a bigger position. Furthermore, the candlestick does suggest that there is support underneath, and it is worth noting that the last three days in a row have seen buyers at the exact same area. That along with the 200-day EMA sitting just underneath does make an argument for more supportive action. We will eventually get to the $2100 level again, but it will take some time to get there. Shorting gold is something that I have no interest in doing anytime soon, as even though we have pulled back a bit over the last couple of months, we are still very much in an uptrend.