The gold market fluctuated during the trading session on Friday as people focus on the holidays. At this point, the $1900 level continues to be a major barrier that we need to overcome, but we will do just that in time. The next couple of sessions will be very thin as we approach the holidays, and thereby we are looking at very choppy conditions just waiting to happen.

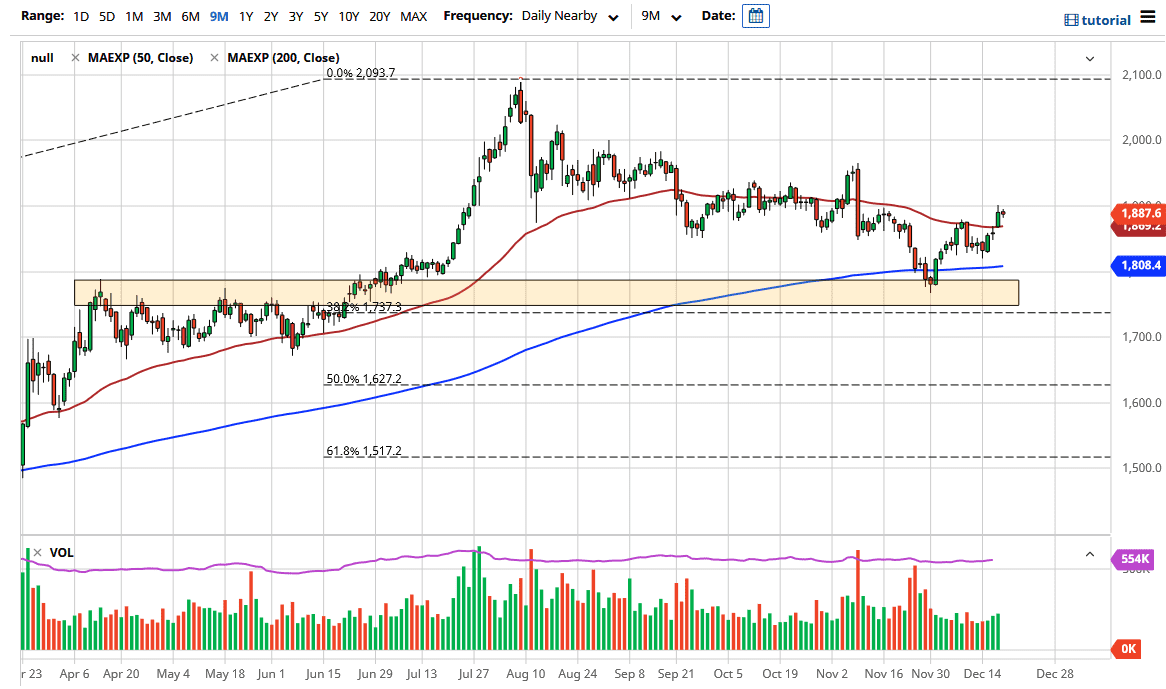

To the downside, the 50-day EMA sits just below the Thursday candlestick and should offer some psychological and structural support as well. There is also a gap just below there, which is worth watching. Under all that, we have the 200-day EMA, which is closer to the $1800 level. That is an area which had previously been massive resistance and has also offered support already, so we are simply trying to find a reason to go higher, which very well might be stimulus. I like buying dips, and I think that we will eventually go looking towards the $1950 level above, which is where we have broken down previously and should offer a nice target.

Eventually, we will see value hunters come back into this market on the steps, and the US dollar is on its back foot. The lack of volume over the next several days could be a major problem, though, so you need to be cautious. To the upside, I believe that the $2000 level is also another major barrier, and breaking above there would almost certainly open up the gateway to the most recent highs. We are in a longer-term bullish cyclical market for gold, especially if the US dollar continues to fall in the US Dollar Index on a longer-term standpoint. Pay special attention to the 88 handle and that contract, because if we break down below there it is likely that gold will skyrocket as the US dollar gets hammered. Buying on the dips should continue to work but I would be very cautious about my position size for the next week or so.