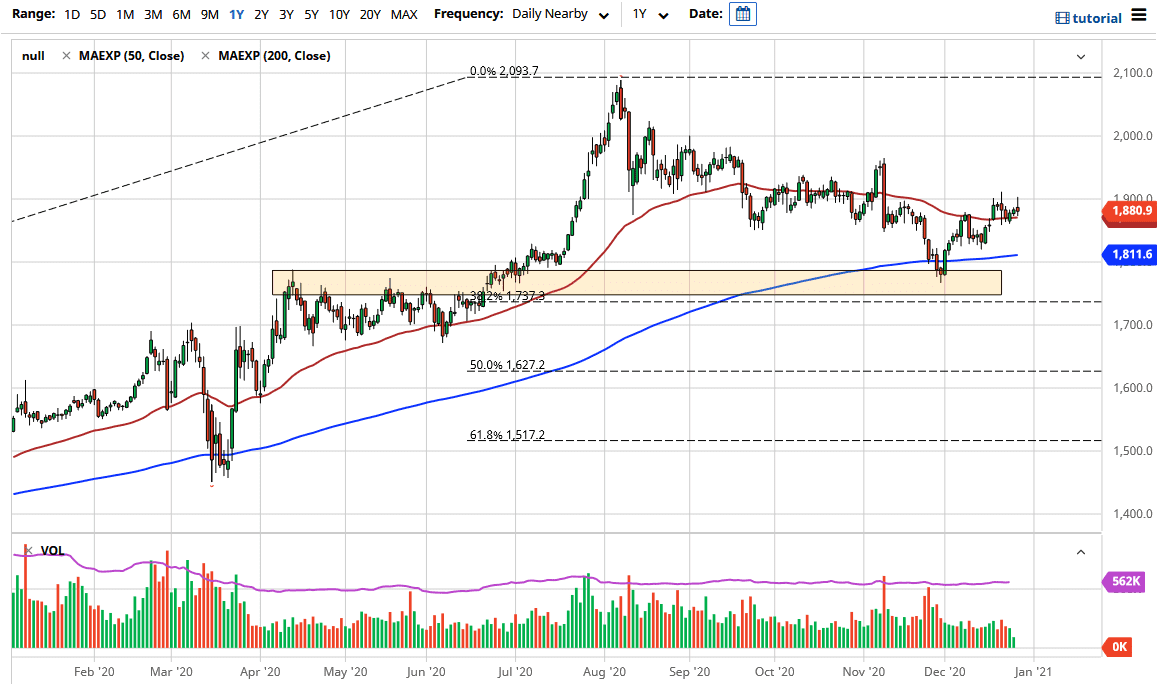

The gold markets tried to rally during the trading session on Monday in what would have been very thin trading. It looks as if the $1900 level has offered significant resistance, and then turned around to form a shooting star. The shooting star sits on top of the 50-day EMA, so we need to pay attention to that technical indicator. Many traders will indeed be paying attention to it, so short-term pullbacks will probably continue to attract notice.

One thing you need to pay attention to is the US dollar, and whether it is going to rise or fall. The market is likely to see a lot of cross-currents right now, due to the fact that the volume will be very thin. Furthermore, now that stimulus has been signed, it will be interesting to see whether or not the US dollar continues to decline. If we get a daily close above the $1900 level, then it is likely we will go looking towards the $1950 level next. I believe that the market will not only go to that area, but much higher than that given enough time. It could be based upon the devalued US dollar, or perhaps even a “safety trade”, because there are a whole host of issues that could jump into the picture and have people trying to buy gold.

The 200-day EMA underneath is sitting at the $1800 region, which is an area from which we have bounced significantly. To the upside, we could go towards the $2100 level which was the recent high. We have been grinding lower for some time, but at this point it is likely that we are trying to turn things around and continue the longer-term uptrend. I have no interest in shorting gold, because we will either see US dollar negativity push the market higher, or we could have a safety trade which would send both gold and the US dollar higher. With all of the stimulus around the world and easing monetary policy, it is going to be very difficult for gold to fall over the longer term. Buying on the dips continues to be my plan going forward.