Gold markets fluctuated during the trading session on Thursday but did not make a huge move. After the nasty candlestick that had formed on Wednesday, that was probably good news. The US dollar is getting hammered, which puts a floor underneath the gold market as it is priced in that very same currency.

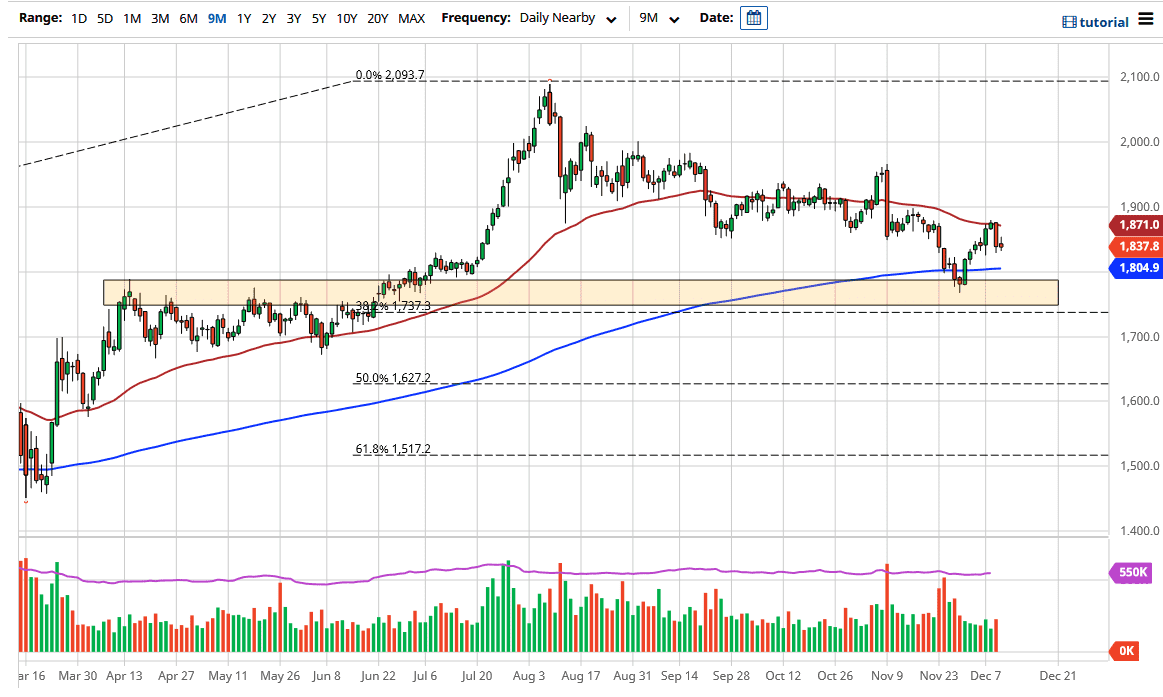

As a matter fact, the 50-day EMA causing resistance during the trading session on Wednesday makes sense, because it is a longer-term technical indicator the people pay attention to. This does not mean that we cannot break above it. In fact, I fully anticipate seeing this market do exactly that. If we pull back from here, I think there are plenty of buyers underneath near the 200-day EMA, which currently is sitting at the $1804 level. Beyond that, we have significant support underneath there where we had bounced from two weeks ago, but it is difficult for me to imagine that we will even get down to that level. Pullbacks towards the 200-day EMA will attract a lot of longer-term traders at this point.

The alternative scenario is that we will simply turn around and take out the candlestick from Wednesday and break above the 50-day EMA. At that point, we will start looking towards the $1900 level and possibly the $1950 level after that. Initially, we will hear some noise, but eventually gold will go looking towards the highs and the $2100 level. However, if we were to break down below the $1750 level, that could spell trouble, but I would only be concerned about it if the US dollar suddenly started to strengthen. That could be the case if there was some type of absolute shock to the system, but right now it does not look like it is on the minds of traders. While the candlestick on Thursday itself was not overly positive, the fact that it was not a continuation of the nastiness on Wednesday is in and of itself a slight victory for the buyers. I think that we are looking for a reason to go higher and push towards the highs again.