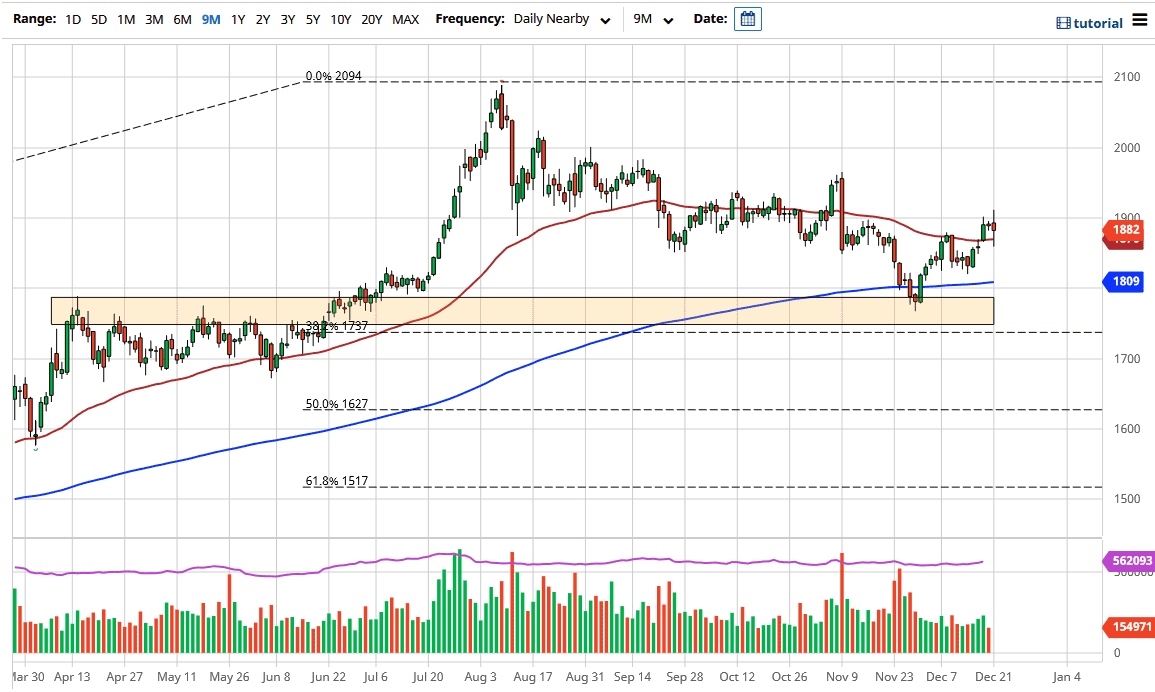

Gold markets have fluctuated during the trading session on Monday to kick off the week, as we started off with a bang. Looking at this candlestick, you can see that we have been both positive and negative, but perhaps the most important aspect is that we have broken below the 50-day EMA to fill the gap below there. That is a strong technical sign, and now we have fulfilled that need. It is not necessarily that we are going to take off straight up in the air, it is just that a technical issue has been solved.

The candlestick has a couple of long wicks, so it shows that there was a lot of confusion. This is not a huge surprise, as people are worried about the coronavirus mutating in the United Kingdom, but it is obvious that there are still buyers for multiple reasons. Looking at this chart, you can see that we did pierce the $1900 level initially, but giving back the gains suggests that we still have work to do. Keep in mind that it is holiday trading, so volume will be a major issue. Because of this, gold could have a huge move based upon very little news flow.

I still believe in buying gold, however, and filling the gap was probably the most important thing that has happened over the last couple of days. Now that it is out of the way, we have the ability to go higher. We will go looking towards the $1950 level, although can it take some time to get there. That is an area in which we have seen a lot of selling in the past, so it follows that we would target it, and probably run into a bit of trouble. We will have to test that area, and short-term pullbacks will continue to be thought of as buying opportunities going forward. I have no interest in shorting gold, and longer term, we will continue to see plenty of reasons to go long.