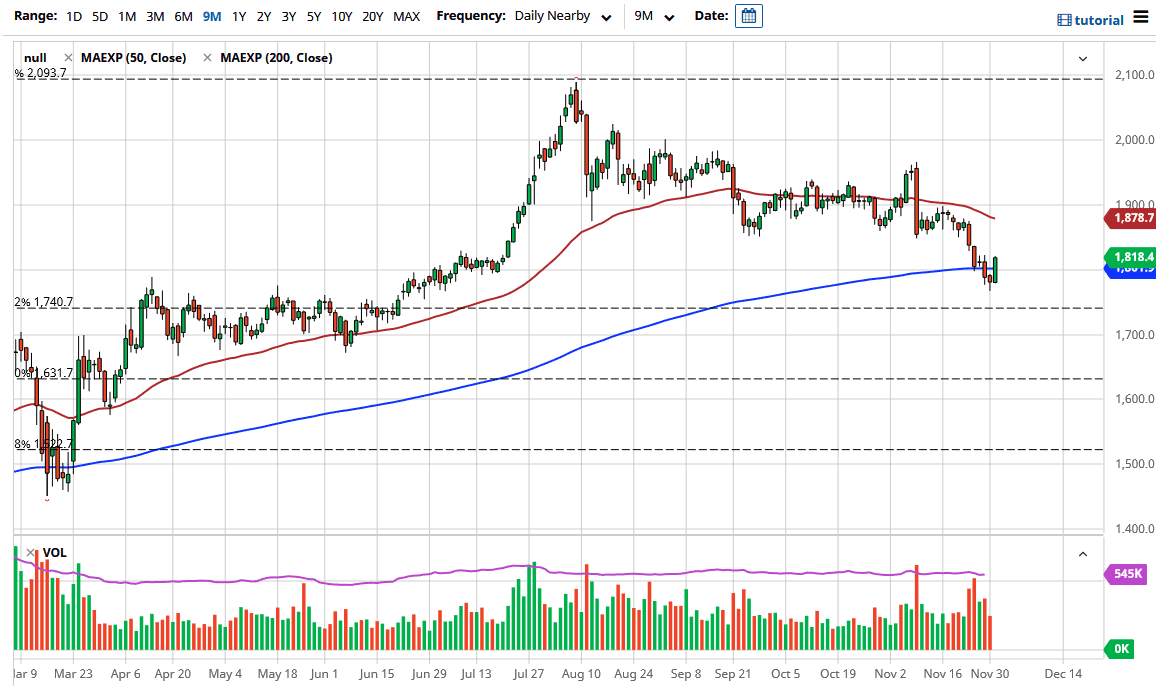

Gold markets are looking strong after breaking above the 200-day EMA again on Tuesday, and after the US dollar got absolutely hammered. As the EUR/USD pair broke above the 1.20 level, it is a good sign that the greenback continues to fall, so gold should get a bit of a boost. With stimulus coming out the United States, it is likely that the gold market will reflect the potential “reflation trade” that seems to be coming out.

Pullbacks at this point should continue to see plenty of buyers, due to the fact that the gold markets have gotten cheap and we have now recaptured the indicator right along with the significant $1800 level. We are looking at a market that has finally attracted enough attention for people to get involved and take advantage of value, as it has suddenly appeared. This market will probably go looking towards the 50-day EMA at the very least, possibly even higher. Have we bottomed? I am not sure, but it certainly looks as if we are trying to form that bottom.

If we break down below the candlestick from the trading session on Monday, that would be negative, but I think buyers will jump back in near the $1750 level, and possibly even the $1700 level. As the US dollar has gotten hammered as of late, it follows that gold will rally. In fact, this is probably the beginning of a longer-term cyclical trade, but it will be very noisy, so be cautious and do not overleverage yourself. Building a larger and longer-term position is prudent, especially if we continue to see the US Dollar Index fall. It had broken through a major support level on longer-term charts, so many people will be looking for ways to get protection from that currency depreciation. As the Senate is very likely to flood the market with fiscal stimulus, it is possible that gold will finally reach towards the highs yet again. Selling at this point, or during the last couple of months if you been paying attention, has been difficult, if not impossible.