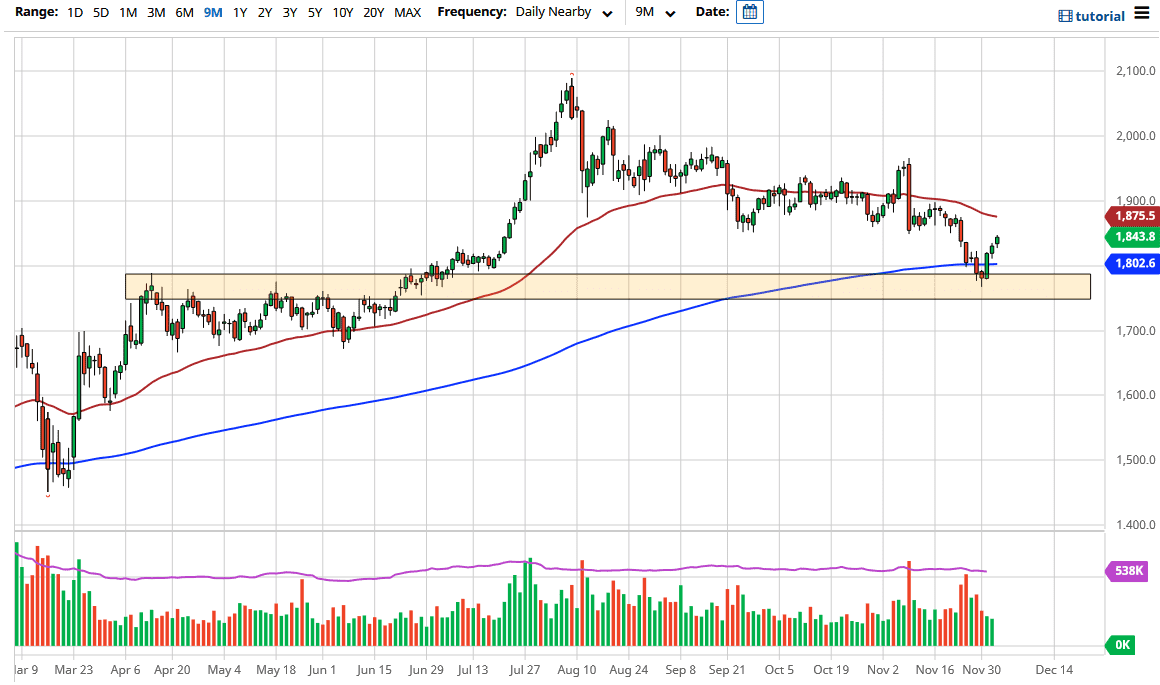

The US dollar falling has been a major push higher for gold, and at this point it is likely that we will continue to reach towards the 50 day EMA but we also have the Non-Farm Payroll numbers coming out during the trading session on Friday, which will have a lot of influence on what happens with the greenback. Ultimately, if we do pull back from here, I think what we are looking at is a potential value opportunity for people who have missed the trade.

The 200 day EMA of course has offered support, as it is an area that a lot of longer-term traders pay attention to. All things being equal, if we do pull back from here, I think that the 200 day EMA should be supportive, especially as it is sitting at the $1800 level. To the upside, we have the 50 day EMA at the $1875 level, which is also where we had broken down from previously. Having said that, I would anticipate a lot of noise but longer-term I do think that this market goes much higher. This is especially true due to the fact that the US dollar has gotten hammered and it looks like it should continue to be the case.

If we break down below the lows of the last couple of days, then the market could unwind rather further. Having said that though, the US dollar would need to strengthen quite drastically in order to sell gold off. The potential of a “V bottom” is being formed right now, and therefore I think that a lot of people will be paying close attention. Longer-term, I believe that we could go towards the $2100 level, which is the recent highs. That is where I think we are going to go given enough time, but that does not mean that it is going to be easy. I think at this point the market will continue to be very noisy and around it, so you need to be cautious about your position size. However, longer-term I am very bullish on gold as central banks around the world continue to flood the markets with liquidity. Shorting is not even a thought at this point in time.