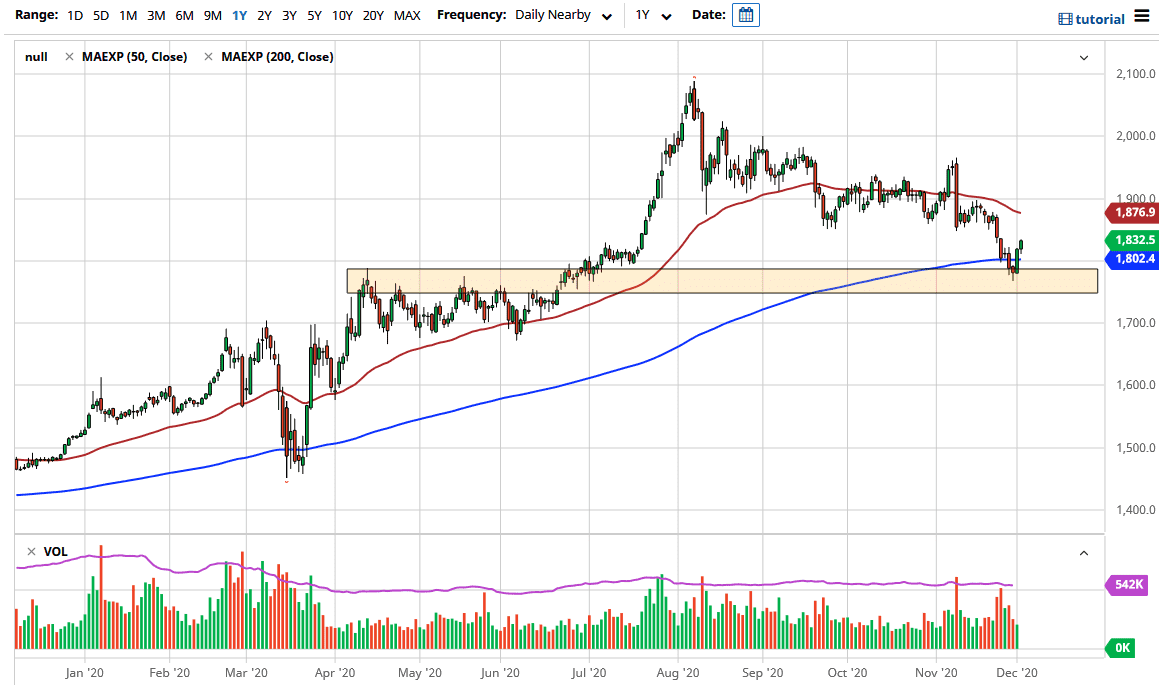

The gold markets have rallied again during the trading session on Wednesday, breaking above the $1820 level rather early in the day and then clearing the $1830 level. Pullbacks will be bought into as the US dollar gets absolutely crushed. Now that we have broken down below a major trendline on the US dollar, it is likely that the US dollar will probably continue to push the gold market higher due to the “reflation trade”, and the gold market will be one of the major beneficiaries. The next target will probably be the 50-day EMA at the $1876 level.

Short-term pullbacks will probably continue to become buying opportunities as we try to push higher. The 200-day EMA has offered significant support, just as the $1800 region has been. This is a market that is eventually going to look towards much higher levels, and pay attention to the fact that the dollar will continue to fall, which will put a natural floor under this market. I think we will go much higher, but it is going to be a day-to-day process with significant pullbacks that could come into play.

There is a lot of noise just above the $1900 level, so it can take significant momentum to finally break through there. But it certainly looks as if we are trying to build a base from the massive pullback, and it is likely that we will continue to see buyers come in and try to take advantage of every little dip, as it will offer value in a market that looks primed to go much higher. Now that the decision on the US dollar has been solved, it suggests that gold should go much higher. This does not mean that we go straight up in the air immediately, but rather over the longer term. I have no interest in trying to short gold, unless we suddenly see the US dollar take off to the upside again, something that does not seem to be very likely to happen.