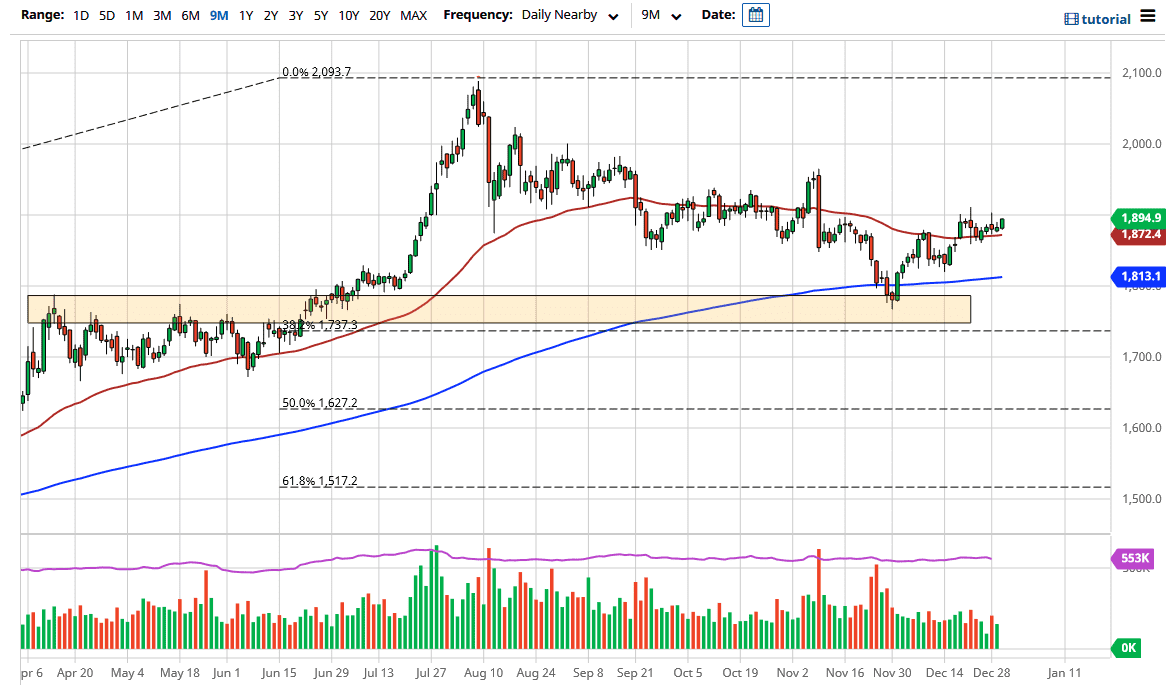

The gold markets found buying pressure during the trading session on Wednesday, reaching towards the $1900 level. The $1900 level is an area that has been both support and resistance. It looks as if we are trying to break out and, with stimulus coming out of the United States, it makes sense that gold continues to rally. After all, the US dollar is going to continue to suffer because of this, and that should send gold higher.

If we do break above the $1900 level in gold, then I think we will go looking towards the $1950 level. That is an area in which we had sold off previously, and now looks as it could be a target if we can finally break out. This is a market that will be very thin over the next couple of days, with Thursday a shortened day due to the holiday. Dips continue to be buying opportunities, especially with the 50-day EMA sitting just below and starting to try to curl to the upside. Even if we break down below there, the market will go looking towards the 200-day EMA, which is closer to the $1813 level. It is not until we break down below the $1800 level that I would consider shorting gold.

Looking at the candlestick, it seems as if there is real intention behind it, and that we should continue to go higher. Precious metals in general continue to be driven by stimulus and US dollar weakness, and we see it not only in gold, but also in silver, platinum and palladium. Gold is the leader, and if we continue to see debasement of the greenback, then they will all move in congruence. Gold eventually will go looking towards the $2100 level, and every time it pulls back, there are a lot of people out there looking to get involved and pick up gold in little bits and pieces. I like the idea of a longer-term “buy-and-hold” type of position, adding when we get bits of value showing up on these pullbacks. The next couple of trading sessions will be thin, but it looks as if we are setting up for a move higher.