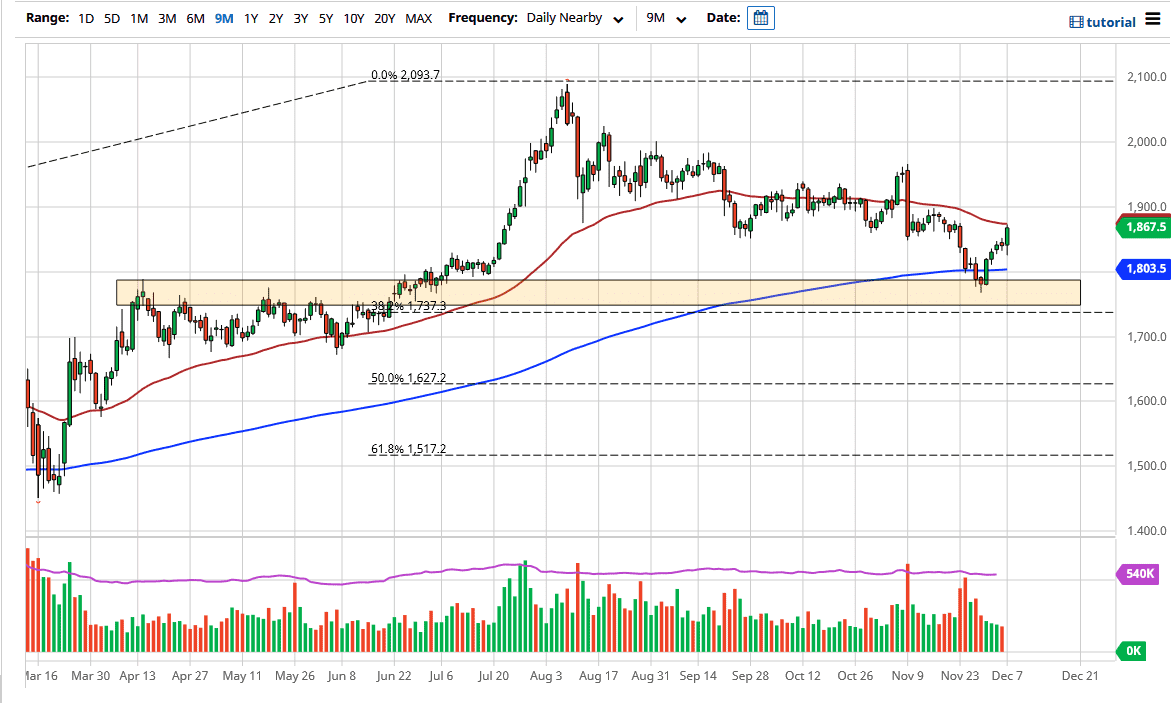

Gold markets initially fell during the trading session on Monday but then turned around to show signs of strength again. The unit of reaching towards the 50-day EMA is the $1870 region. It now looks as if we are trying to reach towards the crucial $1900 level, which was an area of selling previously. It is also a psychologically important figure, so pay close attention to that area, as it could attract a certain amount of selling pressure. We will not only get there, but we will break higher. This is based solely on the idea that the US dollar continues to be sold off, and even though there are many concerns out there that could have money running towards the greenback, it is also possible that we see more of the “safety trade” of gold come back into the picture.

The fact that we pulled back initially and then turned around to gain almost $50 is a sign of just how much strength there is, and it now looks as if we have formed a “V bottom”, which is a very strong sign for buyers. Beyond that, the bottom of the pattern is right about where the 200-day EMA sits, so that is something to pay attention to as well. Longer-term traders will have been interested in the market, and the $1800 level has a certain amount of psychological importance built into it as well, so silver looks like it is ready to continue going higher given enough time. Don't me wrong - I do not think it will go straight up in the air, but it certainly could be a scenario in which traders are really interested in buying dips going forward, thereby offering a certain amount of built-in stability.

I certainly would not be a seller of gold anytime soon, and we have plenty of support all the way down to at least the $1800 level, assuming we even get a short-term pullback. Pay close attention to the US dollar; if it continues to fall against the euro, Australian dollar and many others, then it by extension will have to push the gold market higher.