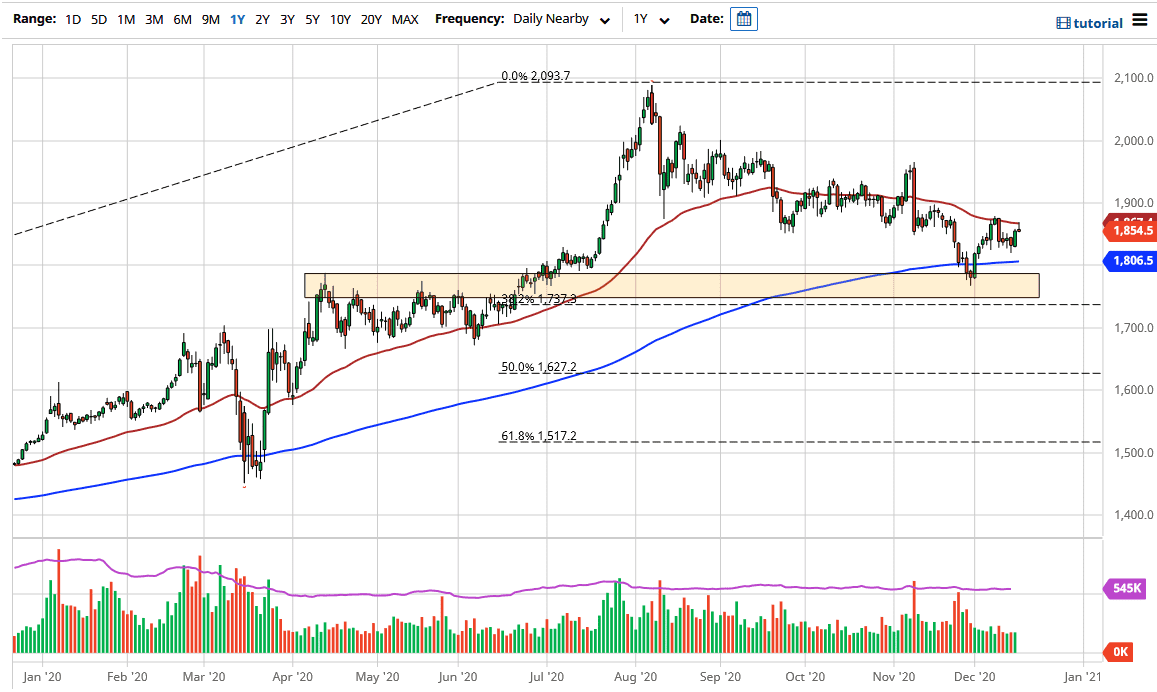

The gold markets fluctuated as we await announcements regarding stimulus and the Federal Reserve, but we will continue to hear a lot of noise. The 50-day EMA is rather important from a technical analysis standpoint, as many traders will pay attention to it. It is only a matter of time before we see a breakout to the upside, though, especially if we see a significant amount of depreciation in the US dollar.

The idea of stimulus will continue to put the US dollar on its back foot, so traders will continue to look towards gold. We have made a nice bottom so far, but that does not necessarily mean that we will take off to the upside straightaway. In fact, we probably have some work to do, but eventually we should see a significant amount of momentum to the upside.

The $1900 level offers psychological resistance, and it is an area in which we have seen a significant amount of selling in the past. It makes sense that we would have a bit of a fight there, not only due to all of that, but because we have also seen selling in that area. To the upside above there, the $1950 level probably will be crucial as well, as there has been a major selling move. Underneath, we have the 200-day EMA right at the $1800 level, so it is likely that we are going to see support.

Longer term, we will go all the way to the $2100 level and beyond. This obviously would have to do with the US dollar breaking down significantly. Paying attention to the US dollar - and more specifically, the 88 level - if we break down below all of that noise, it could really send the gold markets skyrocketing. Gold has a bright future ahead of it, so we will continue to see buyers on each of these dips; but I would do so in small increments instead of trying to jump in with both feet immediately.