The market also gaps to kick off the trading session so that of course is a good sign as well. I believe at this point in time pullbacks will continue to be bought into, especially as we are looking at the very strong likelihood of some type of stimulus package coming out over the weekend or early next week. In other words, that should weigh upon the US dollar and therefore it will take more of those US dollars to buy an ounce of gold.

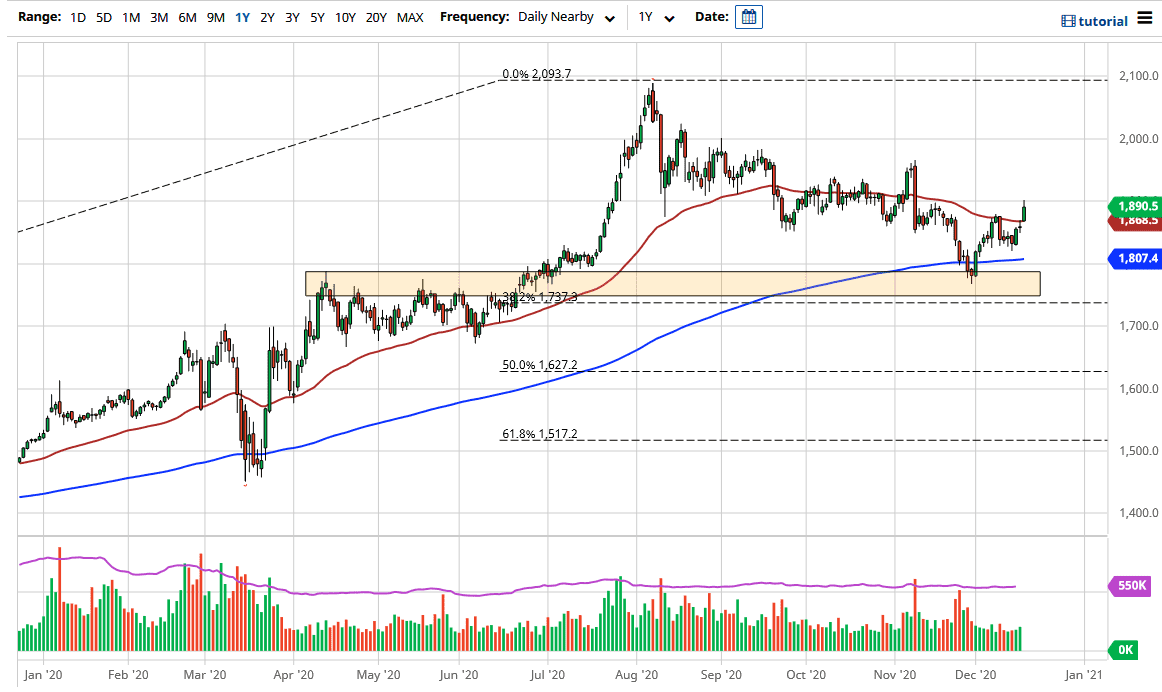

It is not just the US though. After all, central banks around the world continue to flood the markets with liquidity, so a lot of traders will go out there looking towards the precious metals markets in order to protect wealth. The shape of the candlestick is rather strong, and it should not be a huge surprise that the $1900 level caused a bit of trouble. After all, it is a large, round, psychologically significant figure, and an area where we have seen quite a bit of selling in the past. With this being the case, I think that a pullback to build up the necessary momentum to break that level makes quite a bit of sense. If we can break above the $1900 level, then the next target will be the $1950 level. Unfortunately, this is a market that is probably going to be moving on the latest comments coming from Nancy Pelosi, Chuck Schumer, Mitch McConnell, or other politicians. In other words, it could be very volatile but at the end of the day it is obvious that we want to go higher over the longer term.

For myself, I believe that the gold market will eventually go looking towards the $2000 level, possibly even the $2100 level. There is a huge debate right now whether or not we are going to see inflation or deflation, and that still remains to be seen. If we get inflation, that will send gold much higher. We also have the safety trade that could benefit gold as well, so at this point on still point to the upside as far as this market is concerned. The 200 day EMA sits down at the $1807 level and should be a bit of a floor in the market from a technical analysis standpoint.