Gold sold off amid dominant risk appetite in the markets after the announcement of pending coronavirus vaccines. The price of gold fell to $1765 an ounce, its lowest level in four months. Gold investors tried to take advantage of the situation by buying a bounce back higher with gains that did not exceed $1786 an ounce and stabilized there at the time of this writing. However, market optimism be halted at some point, as it dawns on people that vaccine licensing, production and distribution may take time. This is not pessimism, but rather a reality.

Gold futures contracted about 5.6% in November.

Joe Biden’s transition to power began officially last week, ending the great uncertainty. The successful trials of Pfizer and Moderna boosted hopes that a COVID-19 vaccine will soon be released. In this regard, the UK government said it has signed a deal to acquire two million additional doses of mRNA-1273, Moderna’s candidate vaccine, bringing the total to 7 million doses for the UK. The UK now has access to adequate doses of the Moderna vaccine for about 3.5 million people. Meanwhile, recent figures show stability in new cases of coronavirus in Europe, as Britain and France prepare to ease some of the lockdown restrictions.

Data shows that factory activity in China expanded at the fastest pace in more than three years this month, which also contributed to improving risk sentiment.

As for the future of US stimulus to confront the pandemic, Democrats have fought with Republicans and the White House for months over a new batch of COVID-19 relief that all sides say they want. But even some Democrats and the mainstream media have confronted House Speaker Nancy Pelosi for blocking a $1.8 trillion relief bill for American families, which was proposed and supported by President Trump.

Financial aid remains elusive despite the fragile economy and uncontrolled increases in coronavirus cases, especially in Republican Party strongholds in the Midwest. McConnell has replaced Treasury Secretary Stephen Mnuchin as the most important Republican force in the negotiations, but he has not shown much openness towards the politically difficult compromises required for the COVID-19 deal. McConnell's warnings of a flurry of COVID-related lawsuits against companies, schools and nonprofits open during the pandemic also did not materialize, undermining his demand for comprehensive protection against such lawsuits.

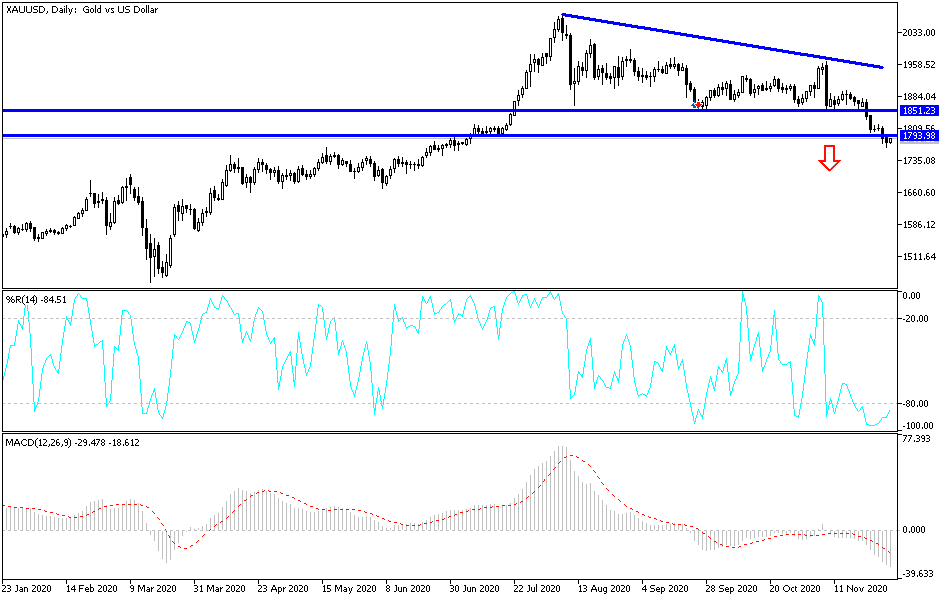

Technical analysis of gold:

According to the performance on the daily chart, gold's stability below the support at the $1800 level supports more downward momentum and stronger bears’ control of performance. Therefore, the support levels at 1782, 1770 and 1753 may be the closest to the current gold performance. The best way to buy is to wait for a bounce and an upward correction, as the technical indicators have started to give oversold signals. On the upside, one must wait for the $1800 resistance level to be broken again. I still prefer to buy gold from every drop.

In addition to the extent of investors’ risk appetite, the price of gold will interact today with the announcement of the Australian interest rates, the reading of the Industrial Purchasing Manager Index from China, the Eurozone, UK and the United States of America, and the reaction to the testimony of Federal Reserve Governor Jerome Powell.