With the near closure of markets for the holidays, the price of gold is expected to move in a limited range with an upward tendency. The price of an ounce of gold stabilized around $1880 as of this writing, closest to the $1900 psychological resistance. Gold seems to be taking advantage of the decline of the US dollar and increasing global fears due to the emergence of new strains of the coronavirus.

In the same performance, silver futures closed stronger at $25.921 an ounce, while copper futures settled at $3.5560 a pound.

US jobless claims showed a significant decline in the week ending December 19, and the US Labour Department report stated that initial jobless claims fell to 803,000, down by 89,000 from the previous week’s revised level of 892,000. Economists had expected unemployment claims to remain unchanged compared to the 885,000 reported in the previous week.

Data from the Department of Commerce showed that durable goods orders rose 0.9% in November after rising by an upwardly revised 1.8% in October. Economists had expected durable goods orders to rise 0.6% compared to the 1.3% jump reported in the previous month. Another report from the Department of Commerce stated that personal income fell 1.1% in November after falling 0.6% in October. Economists expected personal income to drop 0.3% compared to the 0.7% decline originally recorded for the previous month.

The National Association of Realtors released a report on Tuesday that showed US existing home sales declined in November. Also, US consumer confidence declined unexpectedly in December.

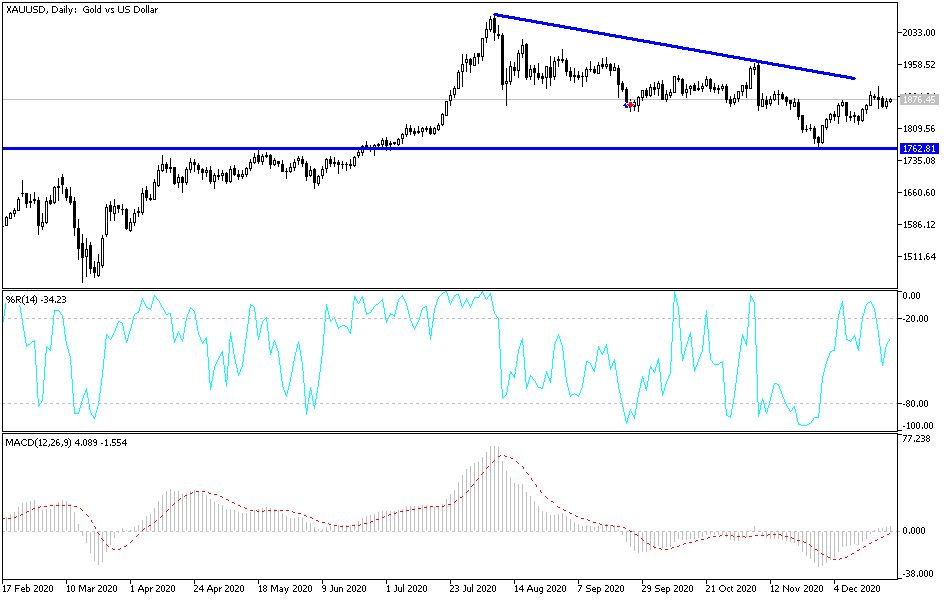

Technical analysis of gold:

So far, the general trend of gold is still tending more towards the upside, and breaking the psychological resistance level at $1900 will increase the bulls' control, thus activating more buying operations. On the downside, the price of gold will fall back strongly if the bears succeed in pushing the price towards the support level at $1820 an ounce. I still prefer to buy gold from every downside and the closest support levels are currently at 1868, 1852, and 1840, respectively.

With an empty economic calendar today, the metal will interact with the extent of investors’ risk appetite, along with the level of the US dollar. With the holiday season approaching, there will be a reluctance by investors to take risks, and thus movements in a limited range are expected during today's trading session.