The price of gold surprisingly moved higher during yesterday's session. It started from the support level at $1775 an ounce, reached the resistance level at $1818 an ounce, and stabilized around $1811 at the time of writing. The price of gold rose from its lowest levels in nearly five months. At the beginning of this week's trading, the price of gold plunged to the support level at $1765 an ounce as the sharp slide of the dollar strengthened the demand for safe assets. Also contributing to gold's rise were data showing weakness in US manufacturing activity in November and hopes that there will be a compromise on the coronavirus relief proposal.

Yesterday's gold gains were the largest for a single session in nearly four weeks.

Silver futures also ended trading stronger by $1.497 - or 6.6% - at $24,090 an ounce, while copper futures settled at $3.4850 a pound.

According to a report by the Institute for Supply Management (ISM), manufacturing activity in the US continued to grow in November, although the pace of growth slowed more than expected. The ISM said that the manufacturing PMI decreased to a reading of 57.5 in November from a reading of 59.3 in October and, according to the index data, any reading above the 50 level indicates growth in the manufacturing sector. Economists had expected the index to decline to a reading of 58.0.

The larger-than-expected decline for the main index came as the new orders index fell to 65.1 in November from 67.9 in October and the production index fell to 60.8 from 63.0. The employment index declined to 48.4 in November from 53.2 in October, indicating a contraction in employment in the US manufacturing sector after one month of growth. On the inflation front, the report said that the price index fell to 65.4 in November from 65.5 in October, but it still indicated the sixth consecutive month of growth in raw materials.

On the other hand, a report issued by the Commerce Department showed that US construction spending jumped 1.3% to an annual rate of $1.439 trillion in October after falling 0.5% to a revised rate of $1.420 trillion in September. Economists had expected construction spending to rise 0.8%, compared to the 0.3% originally reported for the previous month.

In his testimony before the Senate Banking Committee, Federal Reserve Chairman Jerome Powell described the US economic outlook as "unusually uncertain" and indicated that it would depend, to a large extent, on the success of efforts to control the coronavirus.

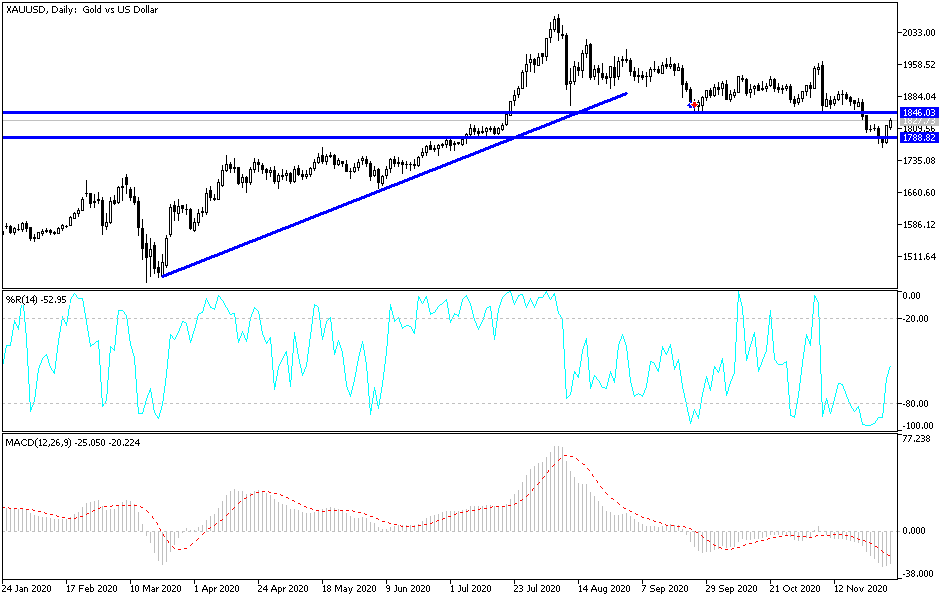

Technical analysis of gold:

I indicated in recent technical analyses of gold that the breach of the support level at $1800 an ounce would push the gold price to stronger support areas. It would thus be an opportunity for gold investors to think about buying, which explains the rapid rebound of the gold price when it tested the support level at $1765. On the daily chart, the price of gold is still moving within a descending channel that was formed in the first third of last month's trading and is still in place. Continued market optimism about the imminent launch of coronavirus vaccines and continued support for the revival of the global economy will remain pressure factors on gold, so a return to moving below the $1800 level is still possible. Accordingly, the closest support levels for the current performance will be 1792, 1777 and 1760, respectively. On the upside, according to the performance on the same daily chart, there will be no new control for the bulls on the performance without penetrating the resistance at $1850 per ounce. I still prefer to buy gold from every drop.