Amid continued pressure on the US dollar, the price of gold rose today towards the resistance level at $1855 an ounce. The move came after a downward momentum at the beginning of this week’s trading, which pushed the gold price towards the support level at $1818 an ounce. The recent rise was bolstered by mounting expectations for a stimulus plan in the near future. Gold price may remain stable around its gains until the monetary policy announcement of the Federal Reserve later on Wednesday. In a similar performance to the yellow metal, silver futures contracts rose 2.5% to reach $24.64 an ounce, while copper futures settled at $35.445 a pound, and as is known, the drop in the USD value greatly supports gains in commodity prices.

A report from the US Labor Department showed that US import prices witnessed a modest increase in November, rising 0.1%, against expectations of a 0.3% increase. Import prices fell -0.1% in October. Meanwhile, the report said that export prices rose 0.6% in November after rising 0.2% in the previous month. Export prices were expected to rise 0.3%.

On the other hand, a report issued by the Federal Reserve Bank of New York showed that regional manufacturing activity rose slightly in December. The bank reported that its General Business Conditions Index fell to 4.9 in December from 6.3 in November. Economists expected the index to decline to 5.8. A report from the Federal Reserve showed that US industrial production rose 0.4% in November after the revised 0.9% advance in October. Economists had expected industrial production to rise 0.3% compared to the 1.1% jump in the previous month.

House Vice Speaker Drew Hamill indicated that the Democratic leader spoke with Treasury Secretary Stephen Mnuchin about a bill to mitigate the coronavirus in a phone conversation Monday night. The proposal calls for a previously unveiled $908 billion relief plan from the two parties to be divided into two proposals that can be voted on separately in order to obtain final approval.

The first bill will be a $748 billion measure, including funds for small businesses, and the distribution of unemployment support from COVID-19, while the other will include more controversial measures such as protecting business liability and helping state and local governments. According to a CNBC report, Pelosi called her fellow congressional leaders to a meeting to try to cut deals to fund the government and send another round of coronavirus relief.

A source familiar with the communication told CNBC that Pelosi had invited Senate Majority Leader Mitch McConnell, Senate Minority Leader Chuck Schumer and House Minority Leader Kevin McCarthy.

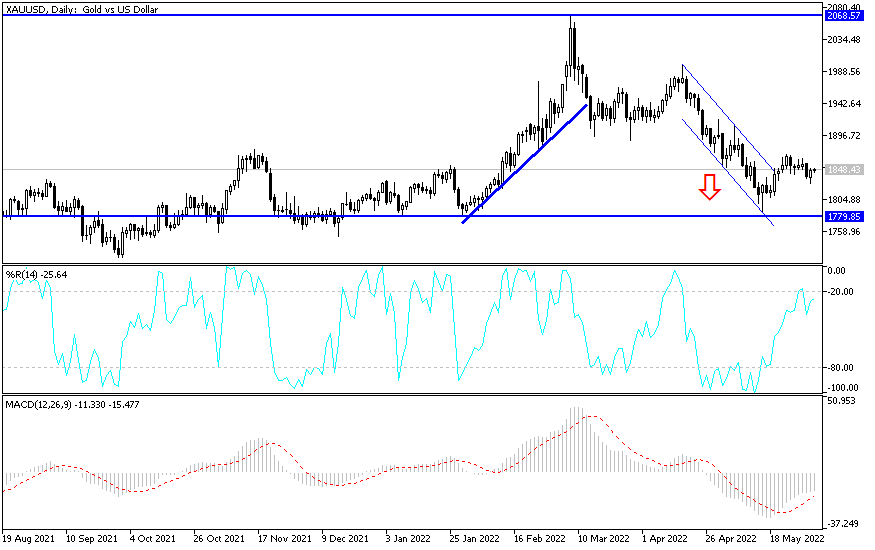

Technical analysis of gold:

According to recent performance on the daily chart, gold is in a neutral position with a stronger bearish tendency. Bears will gain control over the performance if the price of gold moves towards the support levels at 1837, 1820 and 1795, respectively. Gold investors are still waiting for a downside opportunity to buy gold again. As the yellow metal is still supported by more concern in the future, and with the introduction of coronavirus vaccines, there is more time to permanently close the corona crisis around the world, along with the devastating effects that still exist due to the epidemic. On the upside, if the price of gold moves towards the resistance levels at 1865 and 1880, we do not rule out reaching the psychological resistance at $1900 again.

In addition to the extent of investors' risk appetite, the price of gold will be affected today by the level of the dollar after the US Federal Reserve’s policy announcement, the statements of Chairman Jerome Powell, and the reaction to the economic data results, including US retail numbers and the reading of the Industrial and Service Purchasing Managers’ Index from Europe and Britain.