There was a strong fluctuation in gold's performance at the beginning of this week's trading as it jumped to the resistance level at $1906 an ounce, followed by selloffs to the support level at $1855 an ounce. This movement came amid several factors affecting the strength of the USD in the demand for a safe haven, including the announcement of a new coronavirus strain and the start of an economic shutdown around the world, all originating from Europe. The price of gold has returned to stability around $1880 an ounce at the time of this writing, awaiting a reaction to the release of important US economic data today and tomorrow before the holidays and the year's end.

A new type of coronavirus caused several countries in Europe to re-impose tight restrictions on travel from the UK to limit the spread of the virus. As a result, more than 16 million Britons are now being asked to stay in their homes with the full lockdown coming into effect in London and the southeast of England. The new type of virus, which is believed to be up to 70% more transmissible than the original strain, has been identified in Denmark, the Netherlands and Australia.

On the Brexit front, stalemate over fishing rights in British waters continue to hamper negotiations over a trade deal.

US Congress succeeded in approving long-awaited stimulus plans. The US economy suffered from a renewed recession as the spreading virus intensified pressure on companies and consumers stopped shopping, traveling, eating out and attending sporting and entertainment events. It has steadily weakened key metrics of the economy: retail sales, jobless claims, travel spending. Therefore, more than 9 million Americans faced a complete cut in unemployment benefits if Congress did not approve the new package after months of stalemate. More than 4 million Americans have already used all of the unemployment benefits available to them, which lasts for 26 weeks in most states and will be able to reapply.

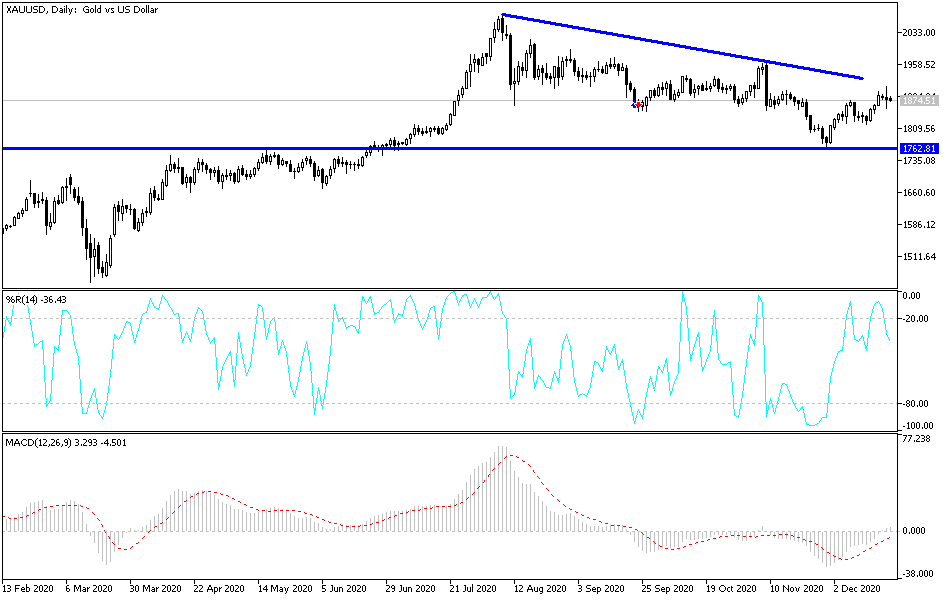

Technical analysis of gold:

Although gold prices crossed the psychological resistance at $1900, the general trend of the yellow metal still has the opportunity to rise as shown on the daily chart. Bulls' control levels are at $1889 and $1,900. On the other hand, a slide below the $1864 support would allow the bears to gain some control and push prices back into the support areas between $1835 and $1818, respectively, again. I still prefer to buy gold from every drop.

In addition to the extent of investor’s risk appetite, the price of gold will interact today with the announcement of the growth rate of both the UK and the US economies, the path of the coronavirus outbreak and the decisions of governments around the world to contain the deadly epidemic.