The price of an ounce of gold pushed to the $1900 resistance at the beginning of this week's trading, but quickly retreated to the $1869 support before stabilizing around the $1879 level as of this writing. Stock markets got some support in response to the news regarding the massive stimulus in the United States and developments on the coronavirus vaccine front. Also, reports about the post-Brexit trade deal between the European Union and Britain and the recovery of the dollar from low levels contributed to the decline in the price of gold.

Before the beginning of this week's limited trading, US President Donald Trump signed legislation worth $900 billion in economic aid for the coronavirus and $1.4 trillion in government spending, providing support for millions of Americans and avoiding government shutdowns. He had previously threatened to block the agreement. Trump said in a statement: “I sign this law to restore unemployment benefits, stop evictions, provide rental assistance, add money to the public-private partnership, get our airline workers back to work, add more money to distribute vaccines, and much more."

Gold prices initially responded positively to the news regarding Trump's signing of the relief package. After that, prices retreated from higher levels as Asian and European stock markets made strong gains. In the same performance, silver futures closed higher at $26.53 an ounce, while copper futures settled at $3.5710 a pound.

The European Union and the United Kingdom announced a post-Brexit trade deal on Saturday, and 27 ambassadors from EU member states formally approved the deal on Monday. However, the agreement still needs to be approved by UK lawmakers before the December 31 deadline.

The E.U. has launched a massive vaccine campaign against the coronavirus. France began its virus vaccination program on Sunday after the French High Health Authority, or HAS, authorized the use of the Pfizer/BioNTech COVID-19 vaccine. Meanwhile, according to reports, the coronavirus vaccine developed by AstraZeneca is likely to receive approval from British authorities by Tuesday.

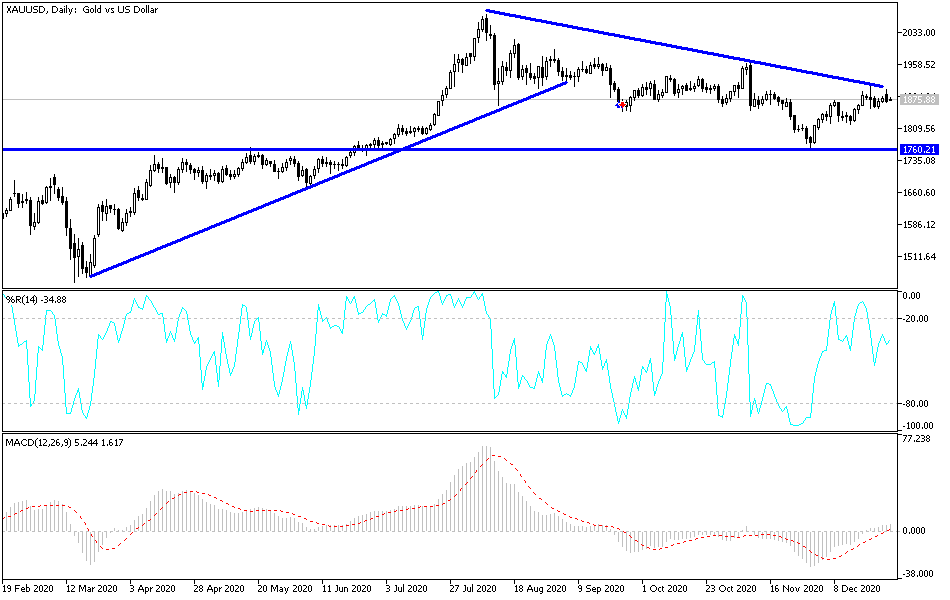

Technical analysis of gold:

Despite the recent downward movements of the gold price, the general trend is still bullish. Other than that, the bulls' control will remain stronger, especially if the price of gold returns to stability around and above the resistance at $1900 an ounce. In the coming days, the price of gold will interact with the level of the US dollar and the extent of investor risk appetite, amid global efforts to contain the coronavirus and the devastating effects of the pandemic on the global economy, which will need more stimulation as long as the panemic persists. For the second day in a row, the economic calendar has no important and influential releases.