For three trading sessions in a row, the price of gold is moving in an upward correction range and pushed towards the resistance level at $1838 an ounce before settling around $1833. The rebound came after the price of gold moved downward towards the support level at $1765 an ounce following announcements of successful coronavirus vaccines. The reason for the rise in the price of gold is the continued weakness of the US dollar, which fell to its lowest level in two years, amid increasing hopes for a US financial stimulus.

Both Federal Reserve Board Chairman Jerome Powell and US Treasury Secretary Stephen Mnuchin supported more financial incentives to bridge the economy during the next few months of the pandemic. In a Senate testimony Tuesday, Powell suggested that more fiscal stimulus is needed in addition to monetary support for the central bank. “Some financial support now will really help get the economy moving, and safeguard against downside risks, especially for small businesses.” Mnuchin also said he favours "targeted rapid relief."

US Treasury yields fell after Senate Majority Leader Mitch McConnell rejected a $908 billion bipartisan economic stimulus plan.

A report from the ADP payroll processor showed that private sector employment in the US increased less than expected in November. The report said that employment in the US private sector rose by 307,000 jobs in November, after it increased by a revised 404,000 jobs increase in October. Economists had expected an increase in US employment by 410,000 jobs compared to the addition of 365,000 originally reported jobs for the previous month.

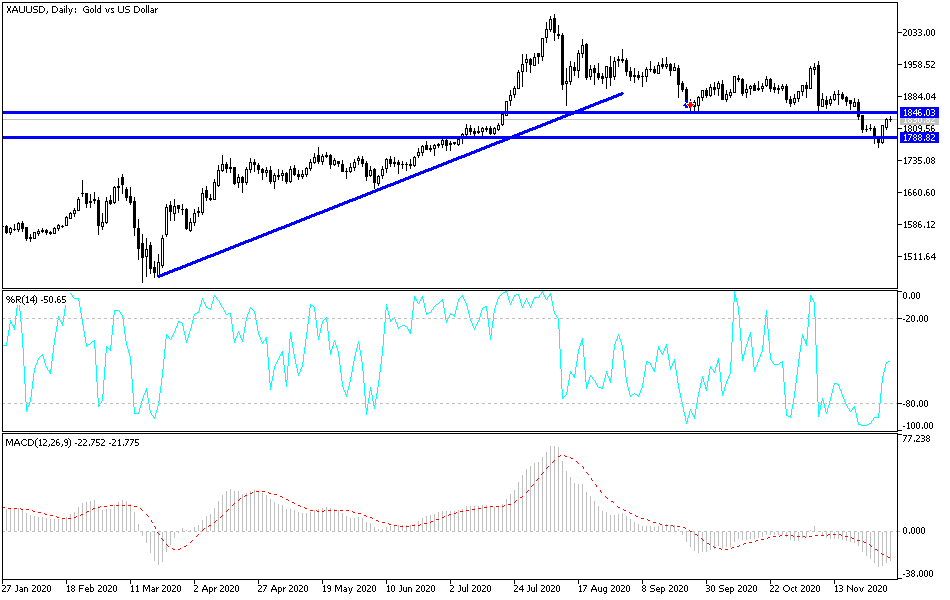

Technical analysis of gold:

On the daily chart, the price of gold began to form an ascending channel opposing the recent collapse, and is so far stable above $1800 an ounce in support of this trend. However, the pressures remain as optimism continues amid positive news of vaccines. Meanwhile, the recent collapse of the US dollar may not last long. The price of gold still needs to move towards the resistance levels at 1855 and 1900, respectively, in order for the bulls to take control. On the downside, failure to move above the $1800 resistance and moving below it will increase the bears' control over the performance again and continue to move in the same path as the November trading.

In addition to the extent of investors’ risk appetite, the price of gold will be affected today by the level of the dollar and by the announcement of the Services PMI from China, the Eurozone, Britain and the United States. Then, there will be a second statement regarding the US labour market weekly jobless claims.