The beginning of last week’s transactions were completely different from those of week's end. This applies strongly to price of gold, which fell to the support level at $1765 an ounce at the beginning of the week, rebounded higher towards the resistance level at $1848 by the end of the week and closed the week’s transactions steadily around $1838 an ounce. The recent collapse of the yellow metal price stimulated gold investors to think about taking advantage of the opportunity and resume buying, and the drop of the US dollar has had an important role in achieving recent gains. The rise in COVID-19 cases in the US, as well as signs of progress in US economic stimulus talks, also helped raise the appeal of the safe-haven metal.

The United States has set a new world record for the number of coronavirus cases and hospital admissions reported in one day. The country recorded more than 14 million confirmed infections as of Thursday, with more than 100,000 patients hospitalized for the first time, indicating that the virus is spreading at an alarming rate.

California Governor Gavin Newsom announced plans for a regional stay-at-home order and warned of widespread closures across the state to contain the epidemic.

The value of the US dollar continues to fall as a $908 billion aid package gains momentum in the US Congress. US House of Representatives Speaker Nancy Pelosi and Senate Democratic Leader Chuck Schumer said that they “could reach an agreement” on the basis of a $908 billion plan drawn up by a group of members of parliament from both parties. While such a package will be welcomed by many, it remains lower than President Trump's proposed $1.8 trillion in September, which was objected to by House Democrats led by Nancy Pelosi.

Accordingly, the US Labour Department report, which showed weaker-than-expected US job growth, added to optimism that lawmakers will have to reach an agreement on a new stimulus bill. Nine million people could lose all unemployment benefits the day after Christmas unless the US Congress approves the rescue package before then. Negotiators on Capitol Hill are seeking to reach an agreement. Commenting on this, Sal Guatieri, Chief Economist at BMO Capital Markets, wrote in a research note on Friday: “The US labour market achieved a very rapid rise in November due to the second wave of the coronavirus.”

According to official figures, the US unemployment rate fell to 6.7% last month from 6.9% in October. This is the lowest unemployment rate since the outbreak in March. The explanation, however, was not encouraging. 400,000 Americans stopped working or looking for work in November. Since these people were not actively looking for a job, they were not considered unemployed. In fact, 74,000 Americans less than the Department of Labour number said they were hired last month. Consequently, the percentage of adults who are working or looking for work - what economists call the labor force participation rate - fell to 61.5% last month from 61.7% in October.

Many of the job gains since April have come from companies calling in workers who left when the COVID-19 pandemic broke out. The trend has continued last month. The number of Americans being temporarily laid off decreased by 441,000 to less than 2.8 million, down from a peak of 18.1 million in April.

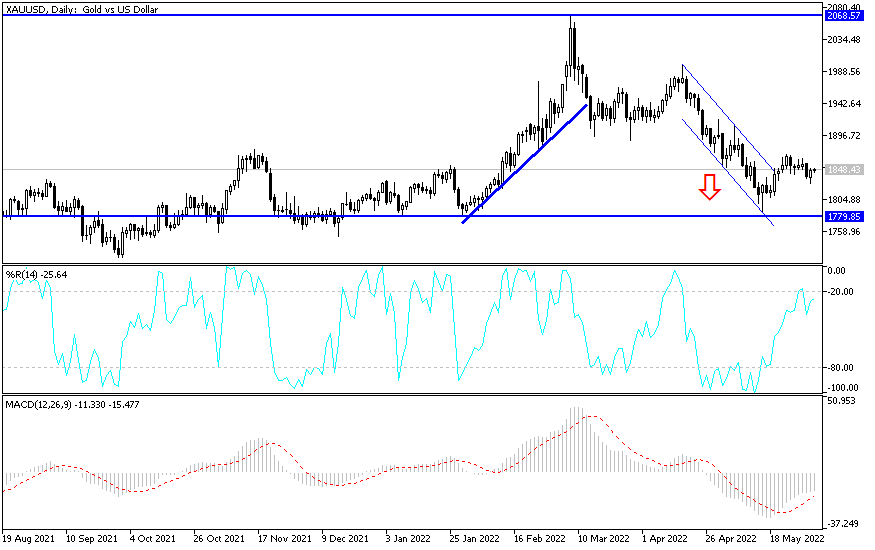

Technical analysis of gold:

Stability below the $1900 level still affects the ascending path of gold prices in the short and medium terms. The bearish momentum may increase if the bears break the $1800 support again. Performance is neutral so far with greater bearishness. The closest support levels for gold are now 1815, 1779 and 1760, respectively. On the upside, as I mentioned, the $1,900 resistance is important for a stronger bulls’ movement. All in all, I would still prefer to buy gold from every drop.