Sharp losses in the US dollar were a major factor in the rise of gold and silver futures, especially after the conclusion of the monetary policy meeting of the US Federal Reserve Board. Precious metals reaped strong gains and sustained them after the US central bank’s decision to keep interest rates unchanged near zero and encouraged stimulus from the Federal Reserve, Congress and the White House, while ignoring the performance of US inflation. The price of an ounce of gold rose to $1871 at the time of this writing. The yellow metal has seen selling during the past six weeks due to the increasing optimism in the US economy, but it is still up by 23% since the beginning of the year to date.

Silver, gold's sister commodity, rose strongly in the middle of this week's trading. Accordingly, silver futures advanced 2.89%, reaching $25.355 an ounce. Silver prices have been volatile in recent weeks but are still up 42% since the start of 2020.

The Federal Open Market Committee (FOMC) ended its final 2020 policy meeting, leaving interest rates unchanged at 0.25% and pledging to continue buying government and corporate bonds for as long as necessary. “The committee decided to keep the target range for the interest rate at 0 to 1/4 percent and expects that it will be appropriate to maintain this target range until labour market conditions reach levels consistent with the commission’s assessments of maximum employment and higher inflation to 2% and on its way to reach above 2% moderately for some time,” the FOMC said in its statement.

Accordingly, the US Federal Reserve will continue to increase its holdings of Treasury bonds by at least $80 billion per month and mortgage-backed securities for the agency by at least $40 billion per month until significant progress is made towards achieving the Commission’s maximum targets for employment and price stability.

The price of gold often supports the metals market, and there was an insistence from US Federal Reserve Chair Jerome Powell that financial and monetary stimulus efforts are necessary to help consumers and faltering companies. The Eccles Building doesn't expect a massive economic recovery until after June, so policymakers can increase spending to support the world's largest economy.

US economic activity and employment continued to recover but remained below their levels at the beginning of the year. The course of the economy depends heavily on the trajectory of the virus. The ongoing public health crisis will continue to affect economic activity, employment and inflation in the near term, and pose significant risks to the economic outlook in the medium term.

Meanwhile, Powell has indicated general optimism about COVID-19 vaccines and indicated that it will take time before consumers can "re-engage" in normal activities. The Fed has also released some economic forecasts for the next few years, including a 4.2% recovery in US GDP next year, up from September's forecast of 4% annual growth. The central bank also believes that US unemployment will return to 5% sometime next year.

Accordingly, the US Dollar Index DXY, which measures the performance of the US currency against a basket of six major competing currencies, continued to decline to 90.20. The low exchange rate of the dollar is good for commodities linked to the dollar because it makes it cheaper for foreign investors to buy. As for other metals markets, copper futures rose to $3.557 a pound. Platinum futures eased, at $1037.80 an ounce. Palladium futures rose to $2339.00 an ounce.

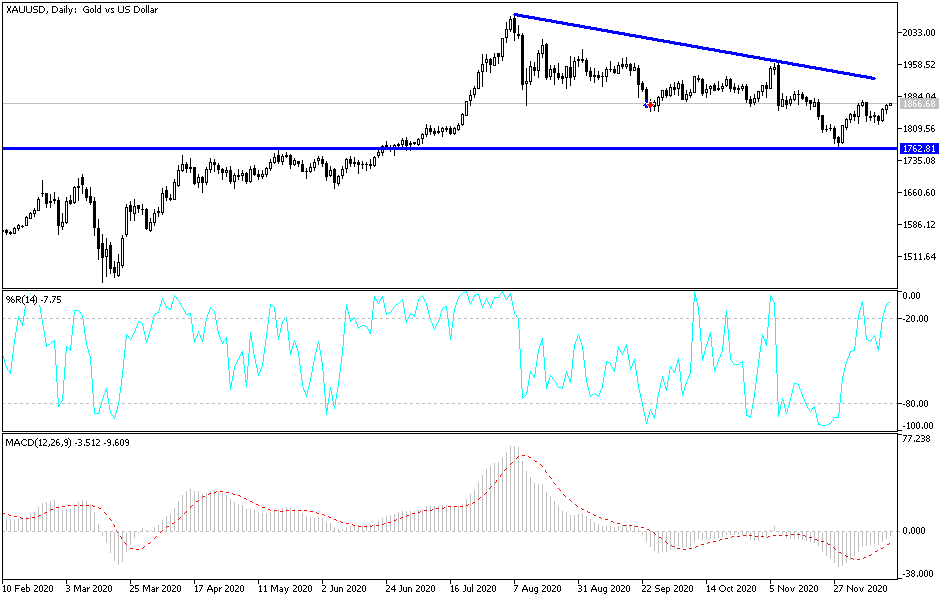

Technical analysis of gold:

After the recent gains in the price of gold, expectations and a positive outlook for the possibility of moving towards the $1900 psychological resistance again increased. I do not rule out this happening, especially if the price of gold moves towards the resistance level at $1885. As it is known, the $1900 resistance is important for more bulls’ control, and thus the buying operations increase, especially if the weakness of the US dollar continues. On the downside, according to the performance on the daily chart, the $1815 support remains the most important for the bears to control performance again.

Gold's performance today, along with the extent of investor’s risk appetite, is waiting for the announcement of the monetary policy of the Swiss Central Bank, the Bank of England, US data on the housing market, the Philadelphia Industrial Index, and the weekly jobless claims.