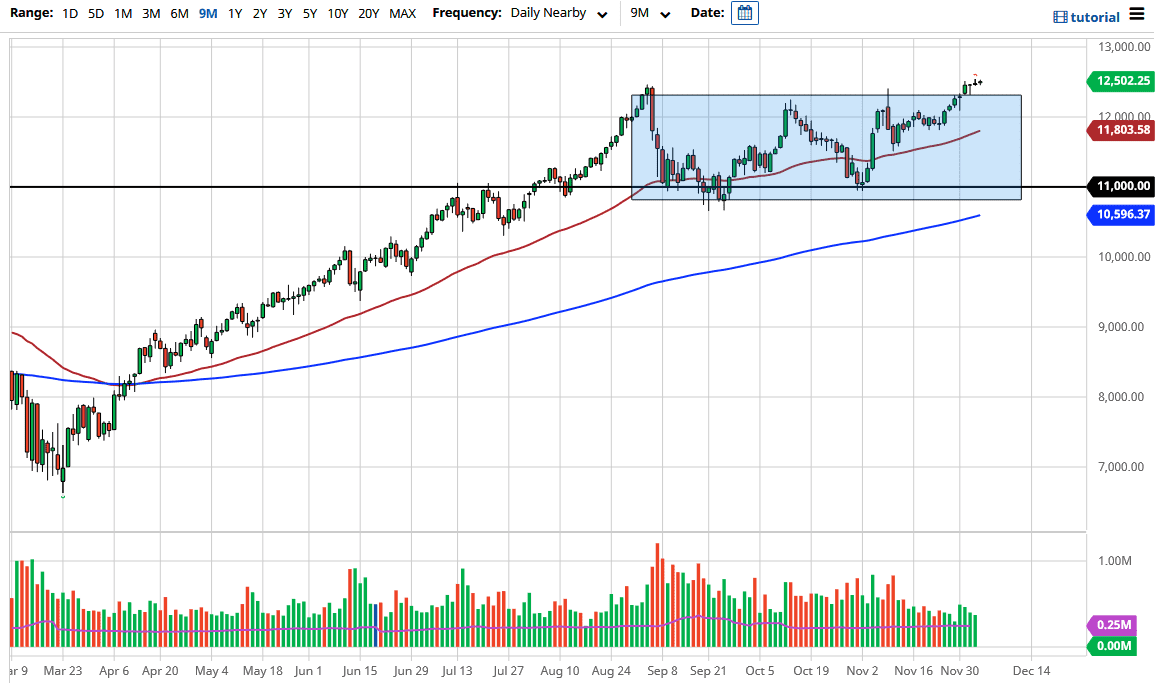

The NASDAQ 100 fluctuated during the trading session on Friday, and a relatively tight candlestick was formed. We are pressing against the 12,500 level, which is a psychological barrier that has been an issue for several days. If we pull back from here, the 12,000 level will probably be the short-term “floor” in the market, but I would be a bit surprised to see that we even got down to that area.

Instead, I believe the 12,400 level will attract a certain amount of support, and that we could go looking towards the 13,000 level. The 13,000 level is a large, round, psychologically significant figure that people will pay attention to as well. The rectangle from which we just broke out actually measures for a move closer to the 14,000 level, so that is my longer-term target. This is not to say that we will get there quickly, just that it is the long-term target, probably something that gets hit next year. Looking at the stocks that make up the bulk of the weight of this index, it does make sense that we will continue to go higher, because it has all the same stocks that everybody is always talking about buying on the financial shows.

Buying pullbacks continues to work going forward, and the shrinking US dollar certainly helps the idea of stocks going higher as well. With this being such a tailwind, it is very difficult to imagine shorting this market. In fact, I think that plenty of buyers will come back into the market every time we dip slightly, as stimulus talks coming out of the United States will probably flood the market with cheap dollars again. If we can get some type of stimulus check out to the general public in the United States, that will probably have people jumping into the market to take advantage of what should be sustained spending even in the lockdown environment. Speaking of the lockdown environment, some of the bigger players in the NASDAQ 100 are highly levered to that as well, so regardless, we have an opportunity to buy this market anytime it shows signs of weakness.