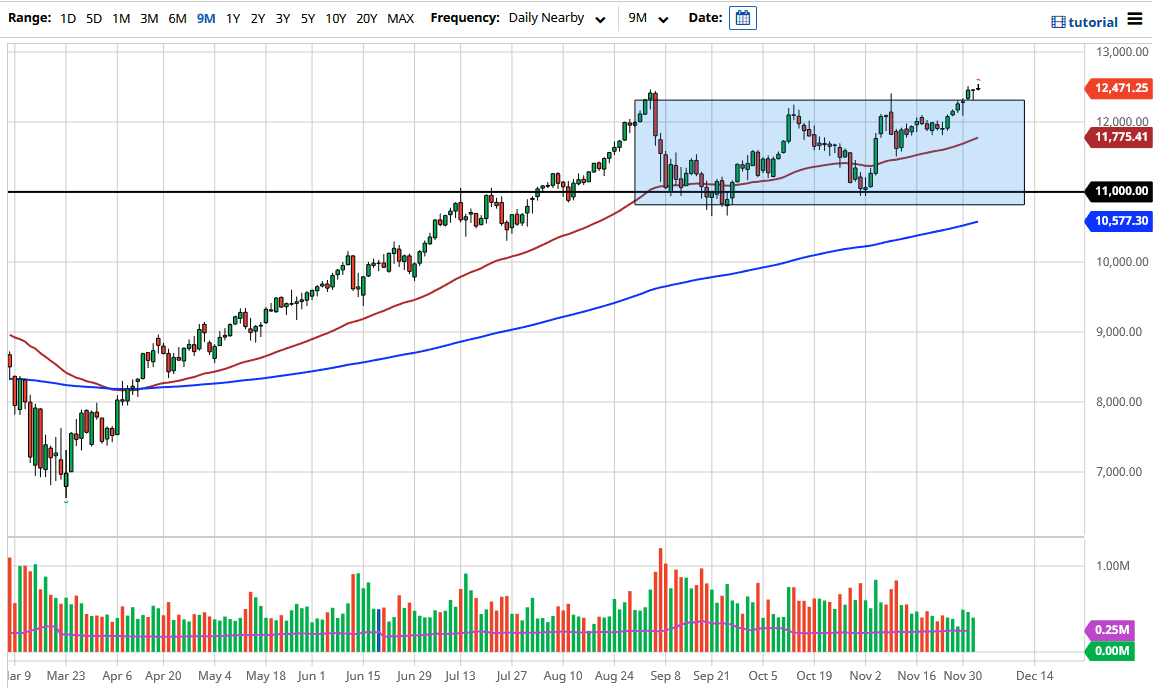

The NASDAQ 100 initially tried to rally during the trading session on Thursday but gave back the gains as the markets are waiting to see the jobs number on Friday. Ultimately, we are a bit extended, but it looks like we are simply going sideways, and it suggests that we are going to continue to see a bit of digestion after the bigger move over the last week or so.

Looking at this chart, the 12,000 level underneath should offer massive support even if we do break down and let us not forget that the Federal Reserve will ride to the rescue for traders, just as the US government will be. Ultimately, the 50 day EMA sits at the 11,750 level, which should also offer plenty of support. I think that buying the dips makes quite a bit of sense, and I think that a lot of traders will take advantage of any value that appears. On the other hand, we break above the top of the candlestick for the session on Thursday, it opens up the possibility of the NASDAQ 100 going towards the 13,000 level, possibly even the 14,000 level.

Keep in mind that the main drivers of the NASDAQ 100 are all of the main household names that a lot of people pay attention to, and therefore I think it is only going higher over the longer term. If you are concerned about any position that you have you can buying puts in this index rather cheap right now, which will protect your position. At this point, we have seen plenty of buyers all the way down to at least the 12,000 level on the short-term dips so I think that should continue to be the way going forward. After all, we just broke out of a consolidation area and ultimately, we should go looking towards the 14,000 level based upon the measured move as well.

I have no interest in shorting and would not do so until we got at least below the 200 day EMA which is close to the 10,600 level. Even then, I still think that you need to be very cautious because there are so many manipulation of the markets due to central banks and government that shorting is one of the most dangerous things you can do.