Without a doubt, the NASDAQ 100 is one of the better performing indices coming out the United States. The market recently broke out of a significant consolidation area, so it looks as if it is trying to set up for a move higher. Keep in mind that the NASDAQ 100 is heavily influenced by a handful of stocks, most of which have benefited from the “stay-at-home trade.” Unfortunately, we will probably see that trade continue in the meantime, due to the fact that coronavirus figures are starting to climb again. Furthermore, we also have new mutations on the coronavirus popping up, so it looks like we are going to continue to lock down.

We have seen an increase in lockdowns in the United Kingdom and are starting to see countries like Japan ban international arrivals even more stringently than before. The market is likely to continue to see a lot of choppy behavior to the upside, but short-term pullbacks should continue to offer plenty of opportunities to go long because technology continues to expand in this type of scenario.

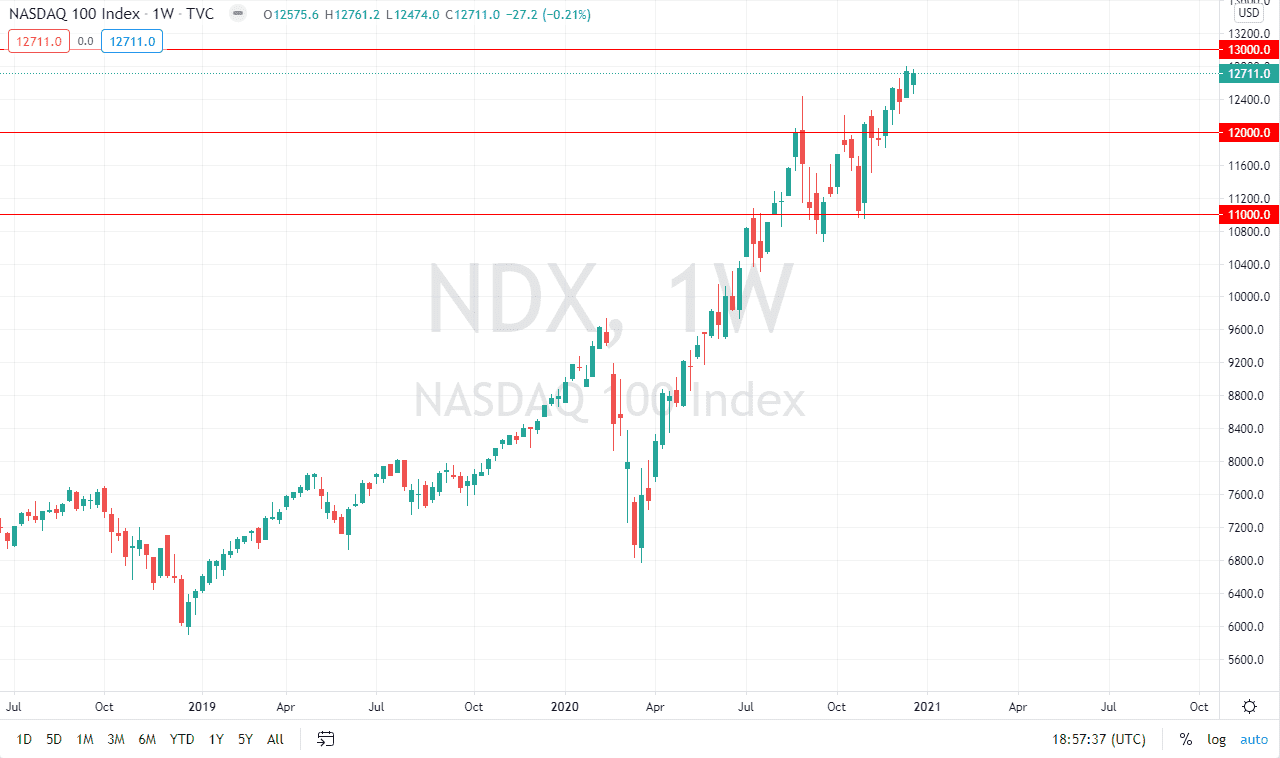

Furthermore, one would also have to like the idea of stimulus lifting socks given enough time. It may take a while, but eventually they will get that done in the United States and that should continue to throw money into riskier assets such as the NASDAQ 100. After all, Wall Street tends to follow a “group mentality”, so it is likely that we will continue to see a lot of money flow right back into the stocks. We would need to see a major change in attitude to see this market roll over, and I believe that there are at least a couple of places in which people will be looking to pick up “value.” Those areas would include the 12,000 level and most certainly the 11,000 level. To the upside, I believe that by the end of the month we will take out the 13,000 level, as we then start looking towards the 14,000 level. Shorting is all but impossible, and any time we pull back it will invite value hunters to pick up the market once it gets “cheap.”