The NASDAQ 100 pulled back slightly during the trading session on Wednesday during very thin trading. The market has been in an uptrend for some time and we did up forming a very similar candlestick on Wednesday to the one that we formed on Tuesday. Both of these candlesticks show that there are in fact buyers underneath, so it is very likely that we are going to continue to see a “buy on the dips” type of scenario.

The NASDAQ 100 is made up of all the “darlings of Wall Street”, as we continue to see lockdowns expand the “work-from-home" environment that we have been trading on for some time. These are still the same companies that everybody has been buying long before the pandemic trade, so I do not think it matters that much at the end of the day. Remember, this is about Facebook, Microsoft, Alphabet, Apple, and Netflix. As long as everybody loves those stocks, by extension the NASDAQ 100 almost has to rally as they are so heavily weighted.

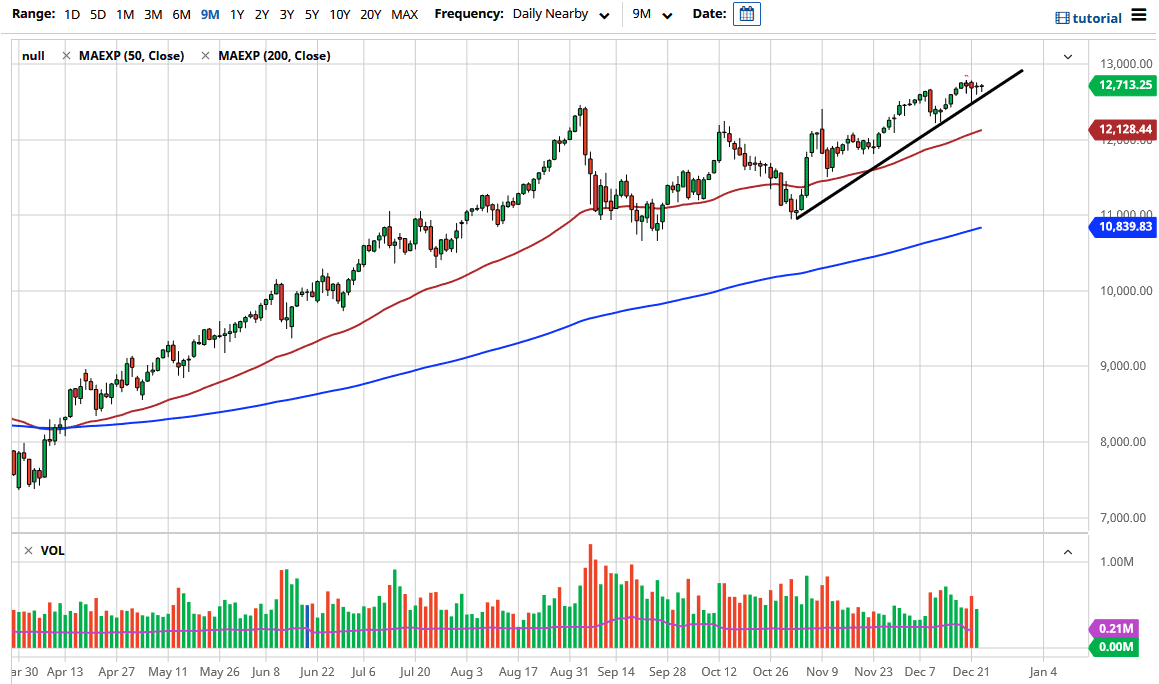

There is a trend line that has been holding so far, and even though there is a certain amount of importance attached to it, we could break through it and it would not change much in the way of my analysis. I believe that the 50-day EMA, which sits at the 12,128 level, should offer support as well, so a pullback probably could be taken advantage of if you are patient enough to wait for the opportunity. Even below there, the 12,000 level would also offer quite a bit of support as well.

To the upside, we may have a target of 13,000 in the short term followed by an even bigger move towards the 14,000 level. We have not done much this week, but we have recently broken out of the consolidation area, which measures for a move to that 14,000 area. I have no interest in shorting this market, because since the Great Financial Crisis, the Federal Reserve and, by extension, the US Treasury Department have not allowed this market to fall for a significant move that sticks. Yes, we had a couple of nasty selloffs, but almost immediately somebody like Jerome Powell steps into the spotlight to save the market. In this market, you are either a buyer or are sitting on the sidelines.