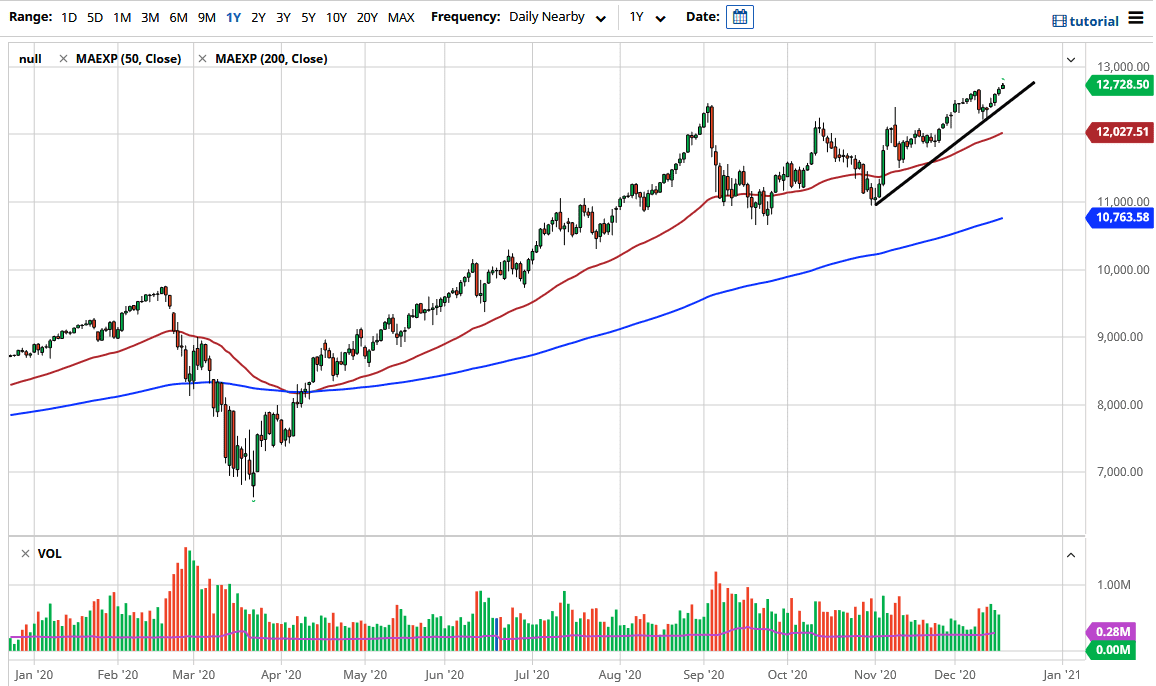

The NASDAQ 100 has rallied significantly again during the trading session on Thursday in what looks to be like a never ending pursuit of the stratosphere. At this point, we are closing in on the 12,750 level, an area that has a little bit of short-term psychological importance to it, but nothing that I would be overly concerned about. In fact, the NASDAQ 100 looks very strong and likely to go much higher given enough time. This is mainly due to the fact that we are starting to see lockdowns again, and of course a lot of those “stay-at-home stocks” are featured in the NASDAQ 100.

The biggest problem we have on Friday is that it is quadruple witching day, which means that for different options classes expire at the same time, causing mass chaos when it comes to indices in general. That being said, I do think that it is only a matter of time before we see some type of decision being made to go higher, and I think that a pullback at this point probably sees plenty of support at the trend line, and then of course underneath at the 12,000 level where the 50 day EMA sits. We also have the “Santa Claus rally” which happens almost every December when money managers have to pad their portfolios with all of the stocks that everybody else owns. After all, when the general public finds out that you did not own any Tesla or Apple, they start screaming.

To the upside I believe that the 13,000 level is a decent target, but I also believe that we will eventually go looking towards the 14,000 level. Between the quad witching and the stimulus talks during the trading session, I believe that the NASDAQ 100 will be extraordinarily volatile, but in the end, it is still very much in an uptrend and that is not going to change anytime soon. I do like this market more than anything else and based upon the measured move from the previous consolidation, one could even extrapolate a move all the way to 15,000 over the longer term. Dips continue to be buying opportunities as they have been for about 10 years, with the exception of a few hiccups here and there. Selling is not an option when it comes to the NASDAQ 100.