The NASDAQ 100 broke out during the trading session on Tuesday as the US dollar has gotten absolutely hammered. Now that the Senate is starting to talk about more stimulus, people are looking towards the stock markets for even more gains. The NASDAQ 100 will continue to attract a lot of attention in general and, due to the fact that it has been a leader, it has many of the “Wall Street darlings” that so many people want to own. Regardless, shorting a stock index right now is tantamount to trying to throw your money out the window, so you should not be looking for shorting opportunities.

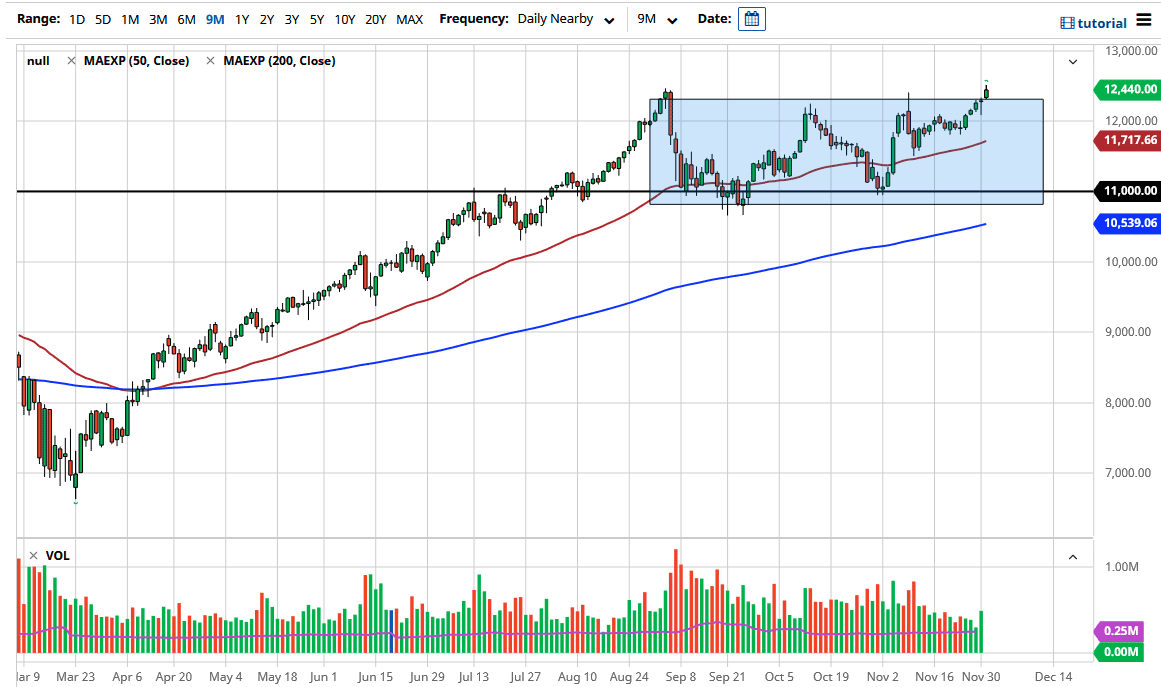

Notice that the most recent pullback has been a buying opportunity at the 50-day EMA and it has been higher than the one before it. In other words, we had been building momentum to the upside to begin with, and Tuesday was simply a combination of all of that. The Monday session was probably more or less rebalancing than anything else, and as traders come back into the stock market, it does make quite a bit of sense that they will assume that it is only a matter of time before more money flows into the market.

Pullbacks at this point should continue to attract value hunters so there is no way to short this market. Beyond that, the fact that we have just made an all-time high certainly will not hurt things either. Plenty of people will be looking at every potential pullback as a way to add or perhaps even get into the market if they have missed the move so far. The NASDAQ 100 just got fresh legs again, so the projected move should be paid attention to, which I am calling 14,000 for the time being. There is no scenario in which I am a seller, at least not until we break down below the 200-day EMA which is currently near the 10,500 level. All we need to see now are short-term pullbacks to pick up a bit of value, or if you are a longer-term trader, simply buy-and-hold.