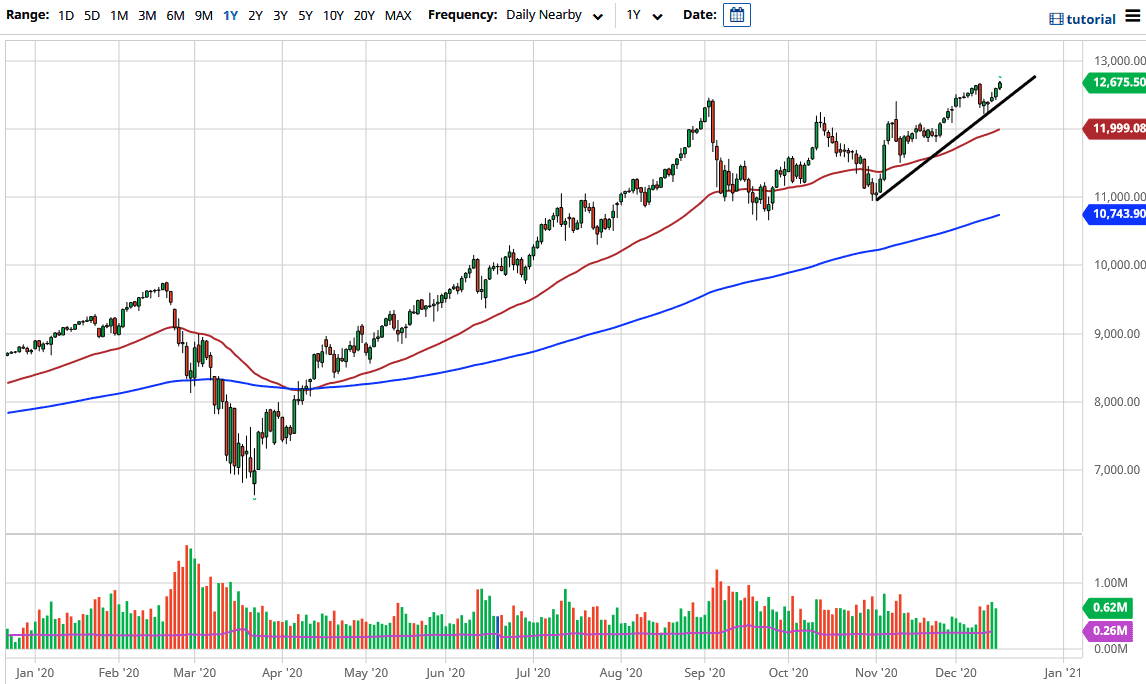

The NASDAQ 100 rallied again during the trading session as we got through the Federal Reserve meeting and announcement. It is likely that we will continue the overall uptrend and the “Santa Claus rally” that we have at the end of every year. Now that we are above the 12,600 level, we could continue to go towards the 13,000 level after that. The market has recently bounced from the uptrend line after forming a couple of hammers, and now a couple of days later here we are reaching towards all-time highs during the middle of the session.

Underneath, if we were to break down below the uptrend line, that is still not a sell signal; it simply means that we will probably go looking towards the crucial 12,000 level. That is where the 50-day EMA currently sits, thereby suggesting that we have support there as well, not to mention the fact that the 12,000 level is a large, round, psychologically significant figure and the place from which we had recently broken out.

The NASDAQ 100 continues to get supported by the “stay-at-home trade”, which makes sense considering that New York, Boston, and London are all facing various forms of lockdowns, so it should drive the earnings into some of the bigger NASDAQ 100 technology companies that everybody else wants to own. Every time we pull back, it will be a nice buying opportunity as we have been in an uptrend. The 13,000 level is the next target, but I have a longer-term target of 14,000. That is probably something that we will see in 2021, especially if we get a significant amount of stimulus that drives money into the marketplace. Looking at short-term pullbacks will be the best way going forward, as the momentum is most certainly picking up. Another thing worth noticing is that we have broken above a very nasty looking candlestick from last week, which suggests that we are ready to go higher as well, as it shows a complete recovery of this market. I have no interest in shorting this market, and I do not even have a set up to make that happen anytime soon.