The NASDAQ 100 pulled back a bit during the trading session initially on Tuesday only to turn around and show signs of strength again. This is a market that will continue to be moved based on stimulus headlines, which continue to be not only substantial but also rumors. It does look like we will get stimulus coming out the United States, which is good for stocks in general, so we will continue to see buyers on dips going forward.

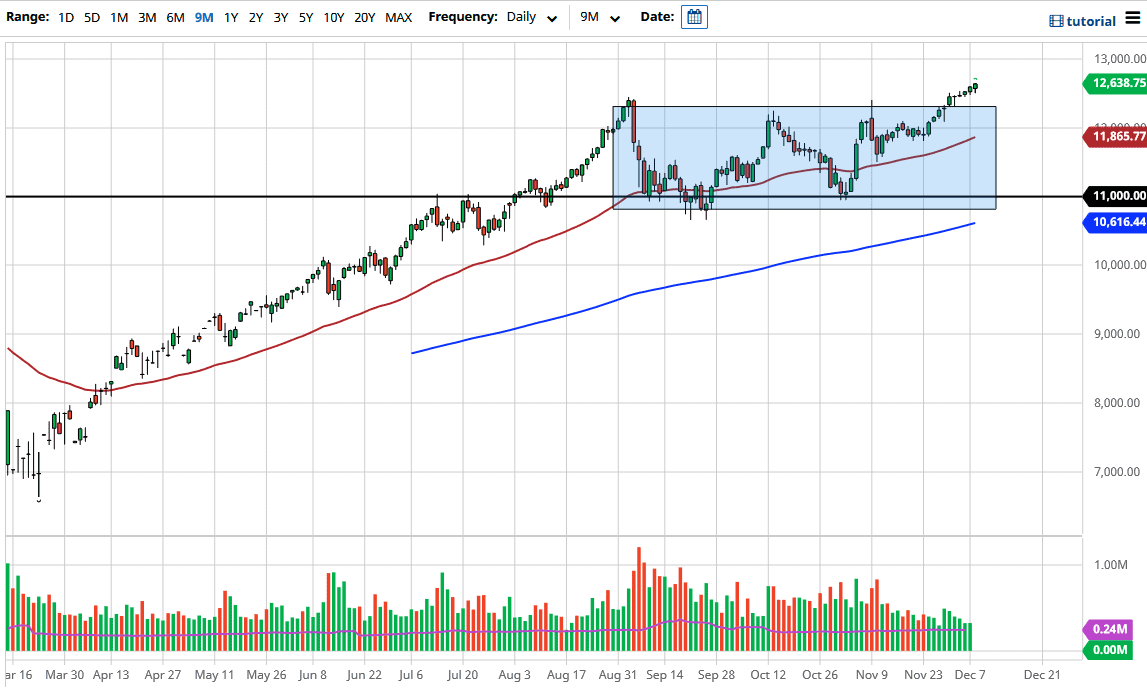

Looking at this chart, it is obvious that we have broken out, and therefore I think we will continue to reach towards the 14,000 level above. The 50-day EMA is currently reaching towards the 12,000 handle, which is a large, round, psychologically significant figure, and an area in which we had started to accelerate to the upside. There is a lot of interest in this general vicinity, so buyers will continue to come back into this market to take advantage of any dip that offers value. After all, the NASDAQ 100 continues to see traders try to take advantage of the longer-term shifts that have occurred in the workplace and the psyche of the crowds in general, because even though we are getting a vaccine soon it is likely that we will continue to see a lot of major shifts in attitudes when it comes to the way we live. Technology has fluctuated between a “safety trade” with the “work-from-home world”, and now it will go back to a growth trade.

This market is almost impossible to short, but if we do get some type of relief to the upward pressure, it is likely that we will continue to see value hunters pushing this market much higher. I believe the 14,000 level is the target over the next several weeks, but between now and then we may get the occasional dips that give us an opportunity to get long. I have no interest whatsoever in shorting this market, because this is a market that is massive in its momentum and the momentum play will continue to show itself.