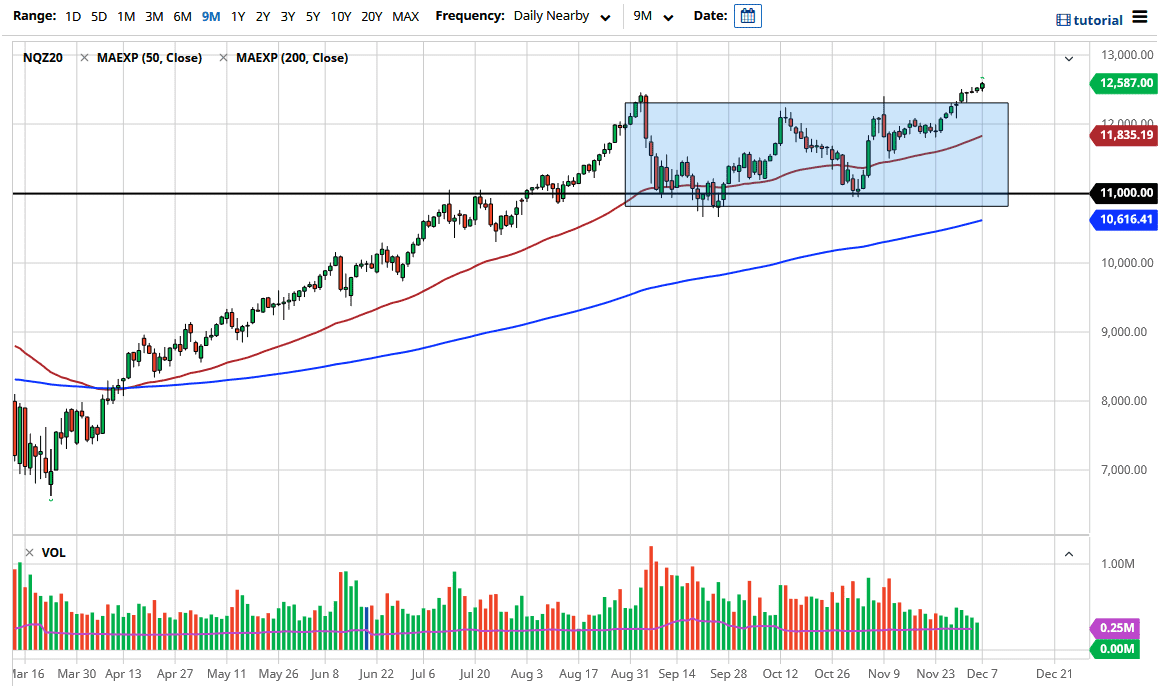

The NASDAQ 100 initially dropped a bit during the trading session on Monday, but then rallied significantly. The market is breaking above the 12,500 level, which is a very bullish sign. The NASDAQ 100 will continue to lead the other indices higher. Every time we pull back it looks like the NASDAQ 100 will continue to find buyers. The market has recently broken out of a consolidation area, so we will continue to have plenty of reasons to believe that it will rally based upon momentum, if for no other reason.

The 50-day EMA sits at the 11,835 handle, and it continues to grind to the upside. The 12,000 level above is a large, round, psychologically significant figure that people will be paying attention to if we do pull back to it, and the 50-day EMA being there would attract attention as well. We are likely to have plenty of value hunters out there. Remember, the NASDAQ 100 moves based on a handful of stocks, those that everybody else in the world wants to own. We are talking about Microsoft, Netflix, Amazon, Alphabet, Facebook, and so on. In other words, this market essentially cannot drop for a significant amount of time. I know as an analyst I probably should not say, that but all one has to do is look at the last 13 years to understand that you buy the dips.

At this point, I would look at any pullback towards the 12,250 level as a potential opportunity to get long, and I do think that eventually we will go looking towards the 14,000 level above. This is based on the recent consolidation measured move and extrapolating that figure out from the breakout point. I have no interest in shorting, and I would just step out of the way if we get a meltdown, wait for stability on a weekly candlestick, and then buy again. One thing is for sure: regardless of how bad the economy gets, shorting this market is a great way to lose money as we have seen multiple times over the last several years. With this, being a bit of a value hunter is the best way to go going forward.