The NASDAQ 100 rallied significantly during the trading session on Monday to kick off the week on the right foot. People are starting to think about the idea of stimulus, which is pushing down the value of the dollar. All of that liquidity suggests that people will be looking to other markets to protect wealth such as the NASDAQ 100. This market also got a boost from the “stay-at-home” trade again.

De Blasio and Cuomo are both suggesting that New York is going to lock down, and now we are starting to get news that the city of Boston is likely to follow suit. This could have people looking towards those stocks that have worked in the past, due to the fact that various companies such as Netflix, Microsoft and the like all have a certain amount of “stickiness” to the idea of people staying away from the office.

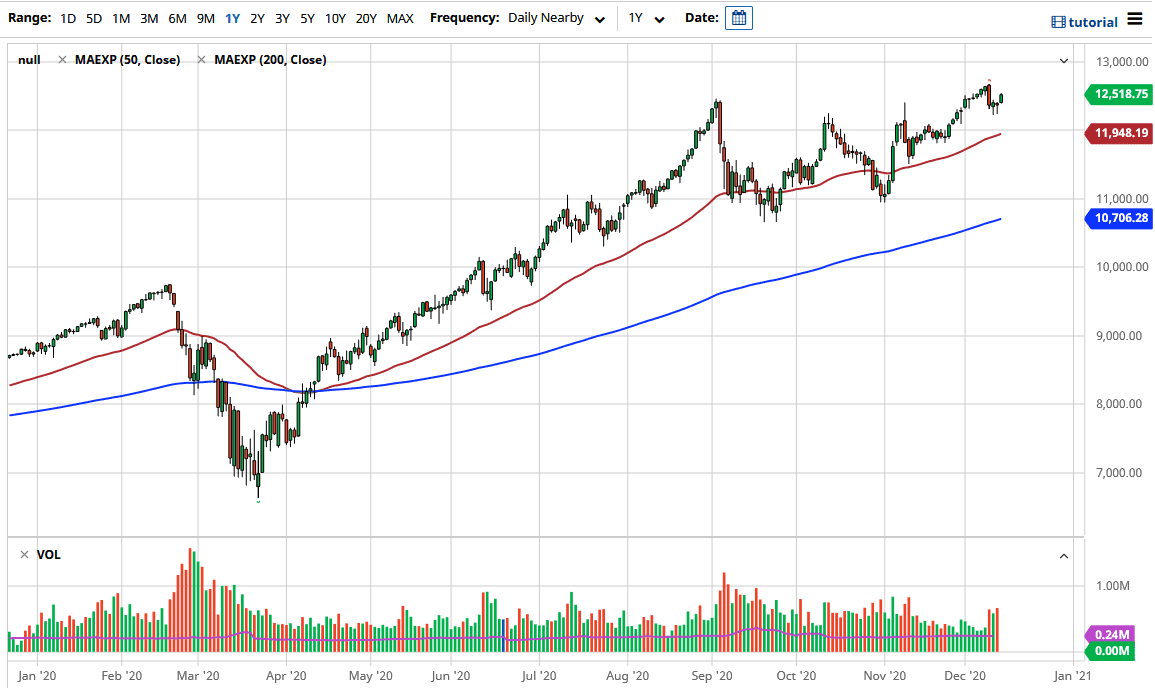

Furthermore, tech is one of the few areas in which we have seen a lot of growth, and that might continue to be the way going forward. Beyond that, you can see that we had formed a couple of hammers on both Thursday and Friday, which suggests that we were always going to try to rally from here. The 12,500 level has been an area that has been quite supportive, so eventually we will continue to go higher and perhaps reach towards the 13,000 level. The 50-day EMA is currently approaching the 12,000 level, which is an area that should continue to be supportive as well, not only due to the EMA, but also due to the round figure sitting at the same level. I have no interest in shorting this market, but I recognize that if stimulus talks break down it could cause a hiccup in the overall uptrend. The market is closing towards the top of the range, which suggests that there could be follow-through down the road.