The NASDAQ 100 had a rough trading session on Monday, just as most other markets did. This was mainly due to the coronavirus mutations in the United Kingdom, which had people concerned about a potential third wave of the pandemic. However, the reality is that this is solely a British phenomenon so far, and the “knock on effect” of the US dollar strengthening the way it has had an adverse effect on stocks in America. The market is still very fragile, but it does show that there is a certain amount of resiliency due to the fact that we ended up forming a massive hammer. This is a bullish sign, especially considering how we have bounced from such a crucial point.

The NASDAQ 100 is a favorite index of day traders, and it features some of the favorite household names that people will use for the “stay-at-home trade”, and some of the high growth stocks as well. As stimulus passes, it should continue to help stocks as well, including the NASDAQ 100. As this index is a bit of a “highflyer”, it is likely that the market will continue to go much higher given enough time.

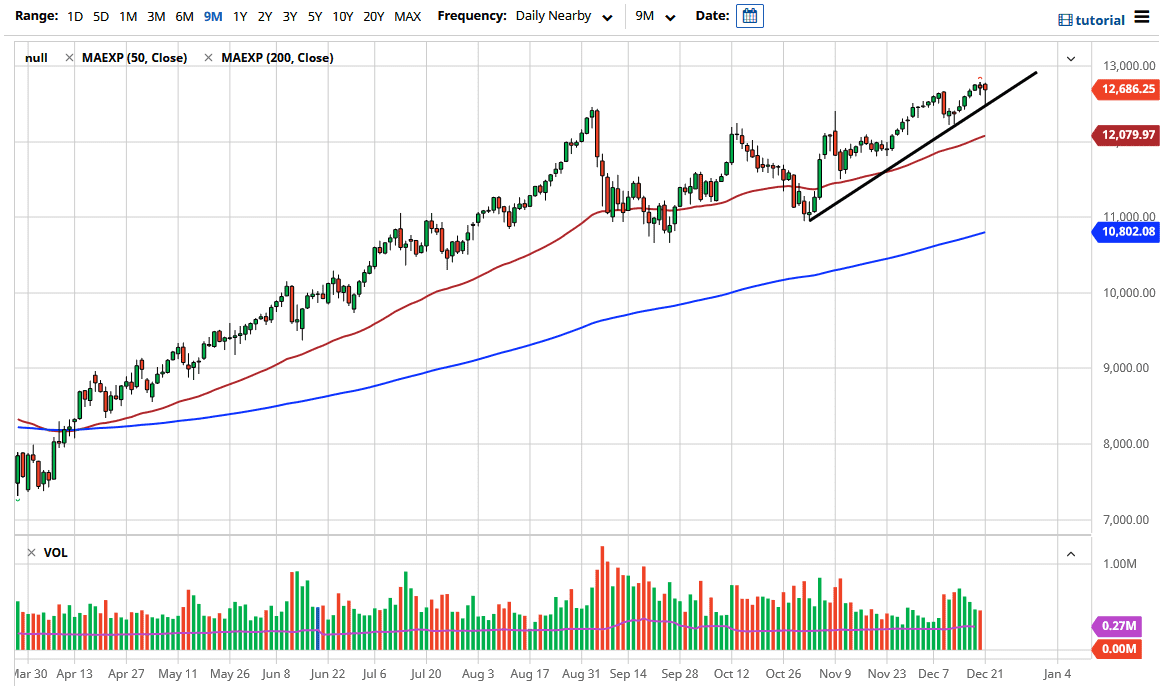

Even if we were to break the trend line, I still think that there is plenty of support down at the 12,000 handle, which features the 50-day EMA. This market should continue to find plenty of interest on these dips, as many people are still trying to live through the “Santa Claus rally.” It is almost impossible to short the market, especially after a day like Monday. If the market could not break down on Monday, it is difficult to understand when it will happen. To the upside, I believe 13,000 will get targeted, followed by the 14,000 level which is still my longer-term goal for the index. If we break down below the 12,000 level, then you could see a bit of negativity extend itself in this market, but we should eventually see buyers there as well. This is a market that has further to go.